First home buyer loans in Rockingham are a key gateway for many aspiring homeowners.

But what are they, exactly?

Here’s your complete guide to everything you need to know about first home buyer loans in Rockingham.

Some are backed by WA government grants that can boost your deposit.

Some offer flexible features tailored to local homebuyers’ needs.

Some come with helpful advice from specialised home loan brokers in Rockingham.

Some loans can vastly simplify your application process.

Some unlock opportunities for buyers with smaller deposits or varied incomes.

Let’s dive right in.

What Are First Home Buyer Loans in Rockingham?

First home buyer loans are tailored home financing options designed to assist people buying their first property in Rockingham, WA.

Unlike standard home loans, these loans often integrate government incentives, specialised features, and local lender benefits. They help reduce upfront barriers like large deposits or high fees, making homeownership more accessible.

Many loans have links to schemes such as the WA First Home Owner Grant or stamp duty concessions, tailored specifically for Western Australian buyers.

For example, certain first home buyer loans Baldivis come with favourable conditions; the same applies in Rockingham, where local lending policies offer unique advantages based on the area’s property market.

Such loans may also come with options for smaller deposits or more flexible credit requirements, reflecting real-life buyer scenarios in Rockingham’s housing market.

What Government Grants and Support Are Available for First Home Buyers in Rockingham?

The WA government, through programs available to Rockingham residents, offers several grants and concessions that first home buyers can access to ease the financial burden.

The standout is the WA First Home Owner Grant (FHOG), which can provide a payment of up to $10,000 when purchasing a new or substantially renovated home under certain value thresholds.

Additionally, the Stamp Duty Concession reduces the upfront tax payable on property purchases for eligible first home buyers, saving thousands.

To qualify, buyers typically need to be purchasing their first home and intending to occupy it as their principal residence.

These incentives work in tandem with first home buyer loans to reduce the costs required at settlement and help build your deposit.

More detailed eligibility criteria and current thresholds are clearly explained on WA’s official government hub.

[

IMAGE: A happy young couple holding house keys outside their first home in Rockingham, Western Australia. Alt: First home buyer loans Rockingham – young first-time buyers celebrating homeownership.]

How Can I Qualify for First Home Buyer Loans in Rockingham?

Loan qualification is a vital step and varies depending on the lender and loan products.

For Rockingham first home buyer loans, lenders primarily look at your financial health, including income stability, credit history, and capacity to repay.

One key benefit of these loans is often more flexible deposit requirements. Several loans allow deposits as low as 5% or even less when combined with grants and concessions.

Additionally, lenders in Western Australia may accept non-traditional income sources or provide options tailored for buyers in Rockingham’s property market.

Partnering with a local mortgage broker Rockingham can boost your chances. They understand local lending nuances and can help present your loan application strongest.

Remember: having a clear budget, organised documentation, and realistic expectations about repayments will streamline your qualifying process.

What Types of Loans Are Best for First-Time Buyers in Rockingham?

Several loan types suit first home buyers, each with benefits tuned to different circumstances.

- Variable rate loans: Flexible repayments with potential for savings when interest rates drop.

- Fixed-rate loans: Predictability in repayments, helpful when budgeting tightly.

- Low deposit loans: Designed to work with a deposit as low as 5%, often combined with government grants.

- Construction loans: Ideal if you plan to build your home, allowing staged drawdowns.

- Family guarantee loans: Where a family member supports the loan to help reduce lenders mortgage insurance.

Knowing which product suits your income and property choices is crucial. An expert lending adviser in Rockingham can help you compare options tailored for local conditions.

Check detailed loan comparisons and eligibility on the How to Compare Home Loan Options in Perth guide for a broader Western Australia perspective.

What Are the Key Benefits of Using a Mortgage Broker for First Home Buyer Loans in Rockingham?

Local mortgage specialists provide a huge advantage when navigating first home buyer loans in Rockingham.

They understand the intricate details of WA-based grants and lender requirements and can access a wider range of loan products than the average buyer.

Here’s why using a Rockingham home loan broker is smart:

- Personalised guidance: Tailored loan options matching your unique financial situation.

- Access to exclusive loans: Some lenders only work through brokers.

- Expert negotiation: Brokers can often secure better terms or rates.

- Paperwork management: Simplifying complicated application processes.

- Local market knowledge: Insights into Rockingham’s property trends and suitable lenders.

If you want to learn more about choosing a specialist, read our Ultimate Guide to Choosing a Mortgage Broker Rockingham.

How Can I Maximise WA State Grants for My First Home Loan in Rockingham?

One of the smartest moves for any first home buyer is to leverage state government grants and concessions.

For Rockingham buyers, this means:

- Applying for the WA First Home Owner Grant (FHOG) for a new or substantially renovated home.

- Claiming the stamp duty concession to reduce upfront costs.

- Considering low deposit loans with government-backed lender Keystart that integrate easily with available grants.

- Seeking advice on the First Home Buyers Grant WA for updated eligibility and application tips.

Ensuring you tick all the eligibility boxes and submit your applications on time is critical to maximising these benefits.

Local experts can also help pre-assess your application so you avoid missing out on available support.

What Are Common Mistakes to Avoid With First Home Buyer Loans in Rockingham?

Avoiding pitfalls saves you time, stress, and money.

Here are frequent traps first home buyers in Rockingham fall into:

- Not researching loans thoroughly: Settling for the first option without considering features or total costs.

- Ignoring eligibility for grants: Overlooking government incentives that reduce upfront costs.

- Underestimating ongoing costs: Forgetting rates, utilities, insurance, and maintenance when budgeting.

- Overstretching finances: Borrowing at or above maximum capacity without buffer.

- Skipping professional advice: Trying to go it alone without local mortgage broker input.

- Delayed application preparation: Not organising documents early, causing approval lags.

When in doubt, ask questions early and lean into guidance from trusted mortgage specialists nearby.

Need a quick attention reset? Did you know local Rockingham home loan experts recommend pre-approval applications as the first step? It clarifies your borrowing power and streamlines your property offers. Get pre-approved before house hunting. It’s a game-changer.

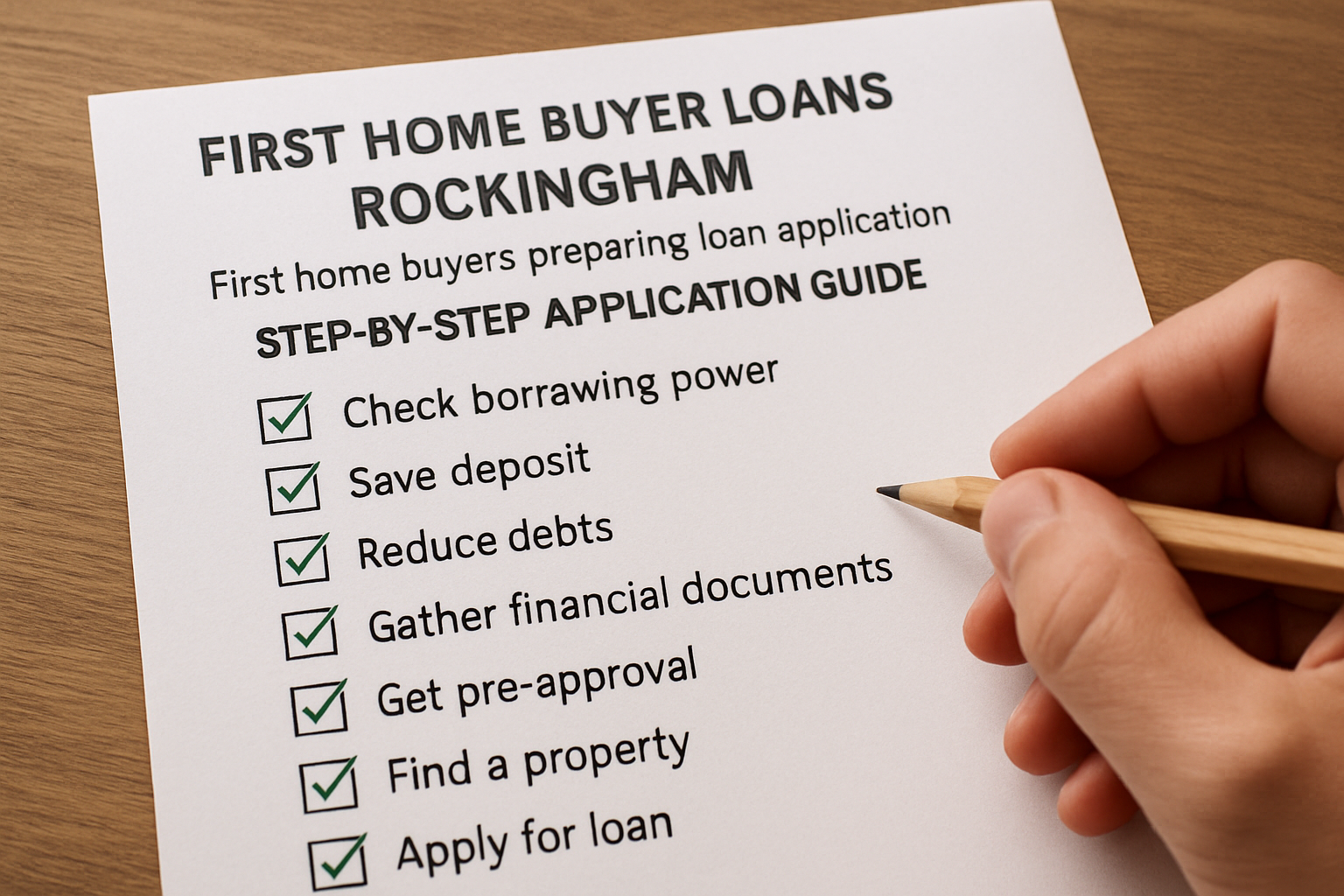

How Do I Apply for a First Home Buyer Loan in Rockingham? Steps Explained

Applying successfully involves several clear steps.

Follow these to keep your loan process smooth and stress-free:

- Assess your budget: Understand your finances and borrowing capacity.

- Gather documentation: Prepare proof of income, ID, savings statements, and any existing debts.

- Research loans and grants: Check eligibility for WA grants and evaluate local loan products.

- Consult a mortgage broker Rockingham: Benefit from tailored advice and loan comparisons.

- Submit your application: Lenders and brokers will handle paperwork and liaise to speed approval.

- Get pre-approval: Secure conditional approval to strengthen your purchase offers.

- Find your property: Shop within your approved budget and preferred Rockingham suburbs.

- Complete loan settlement: Finalise mortgage contracts and property title arrangements.

With the right preparation and expert help, this process can be straightforward, even for first timers.

Are There Special Loan Options for First Home Buyers with Low Deposits in Rockingham?

Yes. Low deposit home loans are a popular category in Western Australia, including Rockingham.

These loans allow you to enter the market with deposits as low as 5% or in some cases even less, often supplemented by the WA First Home Owner Grant and stamp duty concessions.

Examples include products from government-backed lenders like Keystart, which are designed to help first home buyers with limited savings get their foot on the property ladder.

Keep in mind, low deposit loans may come with additional conditions like lenders mortgage insurance (LMI) or restrictions on borrowing power.

Understanding these options thoroughly helps you choose what suits your financial situation best. Our detailed guide on Low Deposit Home Loans Perth offers insights easily transferable to Rockingham buyers.

What Local Property Market Trends Impact First Home Buyers in Rockingham?

Understanding Rockingham’s local property trends gives buyers an edge.

The area has seen steady demand for affordable housing, making it appealing for first home buyers aiming for reasonable prices within commuting distance to Perth.

Supply is growing steadily, but location-specific pockets have varying median prices and growth rates.

Interest rates remain a key factor — loans with variable rates can offer savings if rates drop, but fixed rates offer repayment security.

Collaborating with brokers knowledgeable in Rockingham’s market means you get informed advice on which suburbs and loan types match current trends and forecasts.

This is crucial when timing your property purchase and optimising your loan structure.

Stay updated with local market insights from trusted sources like the Home Loan Broker Rockingham page.

What Are Some Expert Tips for Managing My First Home Loan in Rockingham?

Owning your first home is just the start. Managing your loan smartly can save thousands and protect your investment.

Expert tips include:

- Regularly review your loan terms: Look out for refinancing opportunities to secure better rates or features.

- Make extra repayments when possible: They reduce loan term and total interest.

- Understand your loan features: Offset accounts, redraw facilities, and repayment flexibility can help manage cash flow.

- Stay in communication with your broker: Long-term support can help you navigate changes in your financial situation or market shifts.

- Protect your credit score: Timely repayments and debt management improve your future borrowing power.

If you want guidance on managing not just first home loans but also refinancing or investment finance, explore our dedicated insights such as Navigating Mortgage Refinance in Perth.

What Should I Watch Out for in a First Home Loan Contract?

A home loan contract is a legal document outlining your responsibilities and the lender’s obligations. It’s critical to understand key elements before signing.

Watch for:

- Interest rate type: Variable, fixed, or a mix (split loans).

- Loan term: Usually 25-30 years, impacting repayment size.

- Fees and charges: Establishment fees, ongoing fees, exit fees, and any hidden costs.

- Lenders mortgage insurance (LMI): Required usually for deposits under 20%, adding cost but protecting the lender.

- Repayment options: Ability to make extra repayments, redraw funds, or set up offset accounts.

- Default conditions: Circumstances under which lender can take action if repayments aren’t met.

Having a home finance specialist or lending adviser review your contract can help avoid surprises and ensure terms suit your financial plan.

Quick question to reset your focus: Did you know negotiating certain fees or the loan structure upfront can save you thousands in the long run? Don’t hesitate to ask your broker for options that suit your budget better.

Can I Build My First Home in Rockingham With a Construction Loan?

Absolutely. Construction loans are designed for buyers wanting to build rather than buy an existing home.

They work differently from standard loans by releasing funds in stages aligned with construction progress, ensuring you only pay interest on funds drawn.

In Rockingham, construction loans often come with support related to local building regulations and property market conditions.

Before applying, prepare detailed building contracts, plans, and a reputable builder’s quotes.

Check out our guide on navigating construction loans in Perth — it covers critical timelines, documentation, and expert tips suited for WA buyers.

[

IMAGE: Construction site with happy first home buyer checking on new build progress in Rockingham. Alt: First home buyer loans Rockingham – construction loan for building your new home.]

Why Choose The Mortgage Suite for Your First Home Loan in Rockingham?

At The Mortgage Suite, we specialise in first home buyer loans Rockingham. Our local expertise and personalised approach mean you get tailored solutions that match your unique needs.

We guide you through all options, from government grants to loan types, simplifying complex jargon into clear steps.

With access to a broad panel of WA lenders and insider knowledge of local property trends, we help you maximise your borrowing power and minimise your stress.

Whether you are looking for advice on low deposit loans, construction finance, refinancing, or managing your mortgage post-settlement, The Mortgage Suite is your trusted Rockingham lending adviser.

First Home Buyer Loans Rockingham FAQ

- What is the maximum amount I can borrow for my first home loan in Rockingham?

- Loan amount depends on your income, deposit, creditworthiness, and lender guidelines. Generally, income and expenses determine borrowing capacity, which mortgage brokers can help calculate.

- Can I combine the WA First Home Owner Grant with a loan from any lender?

- Yes, the FHOG applies across most lenders but always confirm eligibility with your broker and lenders to ensure no conflicting conditions.

- How long does it take to get approval for a first home buyer loan in Rockingham?

- Approval times vary; with thorough preparation, pre-approval can take a few days, and full approval several weeks. Efficient brokers can speed up the process.

- Are there special loans for self-employed first home buyers in Rockingham?

- Yes, many lenders and brokers offer loans with flexible income verification to accommodate self-employed applicants.

- Is it better to fix or have a variable interest rate as a first home buyer?

- It depends on your financial goals. Fixing offers budget certainty; variable loans offer rate fluctuation benefits. Many buyers choose split loans. Discuss options with your broker.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your first home buyer loans Rockingham journey? For personalised advice, contact us!