But what exactly does a stamp duty waiver WA entail?

This comprehensive guide provides a cheatsheet on eligibility, thresholds, and recent changes in WA’s stamp duty concessions.

Some are based on the purchase price of the home or land.

Some hinge upon being a first home buyer and meeting specific criteria.

Some involve applying for reassessments and refunds if you later qualify for concessions.

Some depend on the location of the property in relation to WA’s latitude divisions.

Some are connected with associated grants like the First Home Owner Grant.

Let’s dive right in.

What Is the Stamp Duty Waiver WA?

Stamp duty is a state tax payable on property transactions including home purchases and land transfers.

In Western Australia (WA), the stamp duty waiver specifically refers to the first home owner rate (FHOR), a concessional duty applying to eligible first home buyers.

This waiver reduces the stamp duty payable when purchasing or transferring your first home or suitable vacant land.

The concession aligns closely with the requirements of the First Home Owner Grant Act 2000. Meeting these eligibility rules determines your access to reduced duty rates.

The purpose is to ease financial barriers for first home buyers in WA, helping you get into the property market sooner and with less upfront cost.

Key Eligibility Criteria

- Must be a first-time home buyer and meet the First Home Owner Grant conditions.

- The property or land value must be within set limits (e.g., under $750,000 south of the 26th parallel latitude, including Perth metro areas).

- You need to enter into the contract on or after 21 March 2025 to benefit from new legislative thresholds.

- The transaction must be for a suitable home or vacant land with intention to build.

Notably, if you apply for the grant after settlement, you may need to pay the full stamp duty upfront and apply for a refund later.

This system ensures compliance but offers recourse to access concessions.

Recent Legislative Changes and Threshold Updates

As of April 2025, WA introduced important legislative amendments affecting stamp duty concessions for first home buyers.

Transactions entered on or after 21 March 2025 may benefit from increased value thresholds and specific concessions relating to new homes, vacant land, and off-the-plan purchases.

The stamp duty exemption threshold for first home buyers purchasing homes or land south of the 26th parallel is set at $750,000.

If your property exceeds this, the general rate applies, although concessions may continue up to certain higher tiers.

Changes also affect off-the-plan home purchases—welcome news for buyers interested in apartments or townhouses with reduced or no stamp duty payable for homes valued up to $750,000, with concessions tapering on higher-value properties.

These changes are expected to stimulate activity in Perth and regional areas, offsetting rising property prices. (Verified with sources as of 2025-08-19)

REIWA discussed these legislative changes and welcomed the increase to thresholds.

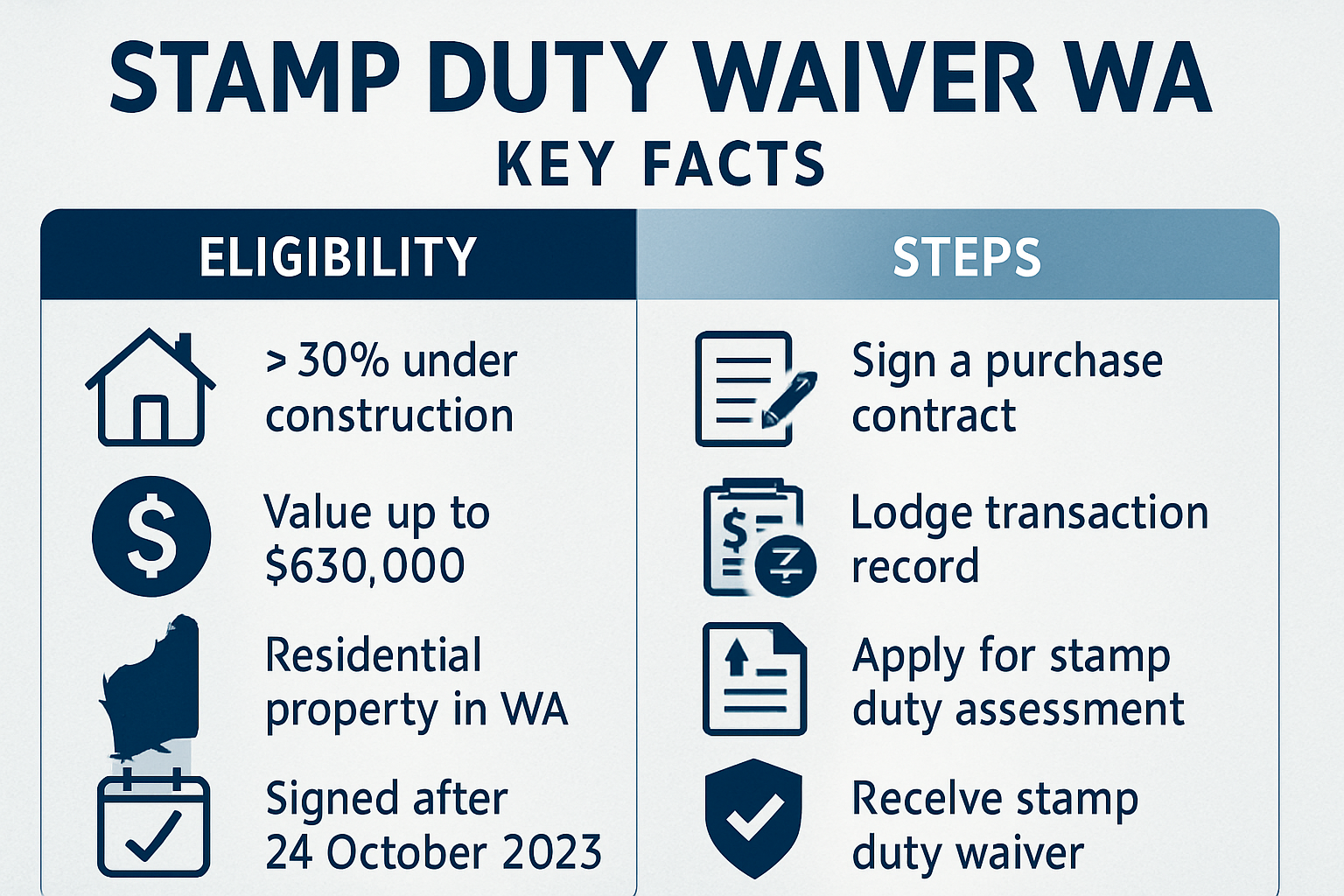

Applying for the Stamp Duty Waiver in WA

Accessing the stamp duty waiver involves a straightforward but critical process.

You must apply to RevenueWA at or before settlement, providing documentation proving your eligibility and adhering to the relevant duty information requirements.

If you do not apply before settlement, the duty is assessed at the usual rate, but you may seek a reassessment and refund upon approval for the First Home Owner Grant.

This reassessment must be lodged through the Online Services Portal and accompanied by supporting documents including the sale contract and grant approval details.

Note that foreign transfer duty applies to foreign persons even when first home owner concessions are involved.

Important Considerations

- The date the agreement is entered into, not settlement, determines eligibility for the first home owner rate.

- Property value assessments consider the full dutiable value, not partial interests.

- False or misleading information on applications carries legal penalties under the Taxation Administration Act 2003.

How the Stamp Duty Waiver Works in WA: Examples and Scenarios

Understanding real-world implications helps clarify the stamp duty waiver’s value and application.

Consider Kate and Simon, one an Australian citizen and the other a foreign person, buying their first home jointly for $400,000.

They qualify for the first home owner rate of duty, so no transfer duty is payable on the property value below the threshold.

However, because Simon is a foreign person, a foreign transfer duty of 7% applies to his 50% share, amounting to $14,000.

This example highlights the nuances buyers must be aware of, especially when more than one purchaser is involved.

Another scenario involves vacant land buyers intending to build a home:

If you enter into a comprehensive contract to build on the land or construct as an owner-builder, you may be eligible for the waiver when buying the land, provided you meet grant conditions.

Keep in mind: The valuation limit applies to the whole land price.

Did you know? If your transaction involves buying partial interests from the Housing Authority, special conditions may apply to qualify for the FHOR.

Reset Your Attention: Why Does WA Offer Stamp Duty Waivers?

Ever wondered why WA focuses on stamp duty concessions? Because it’s one of the biggest upfront costs for home purchasers. The government’s goal is to improve housing affordability, especially for first home buyers, by reducing such financial barriers.

This policy stimulates the housing market and supports state economies by enabling more people to enter home ownership.

How the Stamp Duty Waiver Impacts Baldivis, Rockingham, and Perth Home Buyers

The stamp duty waiver lane runs through many fast-growing Perth suburbs including Baldivis, Rockingham, Port Kennedy, and Wellard.

These areas, south of the 26th parallel, fall under the $750,000 eligibility limit for the waiver, making first home buying more accessible locally.

In high-demand suburbs like Baldivis and Rockingham, reduced upfront costs due to stamp duty savings can significantly improve buyers’ borrowing capacity.

For local residents, applying for the waiver alongside programs like the WA First Home Owner Grant gives a potential financial boost in competitive markets.

Working with a mortgage broker Baldivis or home loan broker Rockingham ensures you understand how stamp duty waivers and grants fit your specific situation.

Local Market Trends and Advice

Property prices in these suburbs sometimes approach the $750,000 limit, so it’s essential to verify property values before purchasing to maximise concessions.

Given market fluctuations, up-to-date advice from local lending specialists or home loan broker Perth experts helps avoid costly surprises.

Related Grants You Should Know About

The stamp duty waiver WA often works alongside other financial incentives, especially the First Home Owner Grant (FHOG).

FHOG offers a $10,000 grant for purchasing or building a brand new home, subject to similar location and value limits.

Eligibility criteria are aligned, so securing the grant typically qualifies you for the stamp duty waiver.

This dual boost lessens the initial costs of home ownership significantly.

Expert Tip: Consider the Entire Financial Picture

While stamp duty waivers ease upfront costs, also consider ongoing loan repayments, insurance, and potential maintenance costs when budgeting.

Engaging a home loan broker Wellard or lending adviser can help tailor finance packages to your circumstances.

Common Mistakes First Home Buyers Make with Stamp Duty Waivers

- Assuming stamp duty waiver automatically applies without applying for the First Home Owner Grant.

- Not submitting documentation prior to settlement, leading to paying higher duty upfront.

- Missing the eligibility cut-off dates based on contract dates rather than settlement.

- Overlooking foreign person status which can trigger additional transfer duties.

- Ignoring the dutiable value limits that apply to the entire transaction amount, not just your ownership share.

Being proactive and informed can save thousands.

How to Check Eligibility and Calculate Duty

The WA government provides an online stamp duty calculator that helps estimate the duty payable and concessions applicable based on your property price and status.

Input your contract date, property location, purchase price, and buyer details for tailored results.

This tool assists buyers in planning finances and preparing applications.

Tour of Steps for Obtaining Stamp Duty Waiver WA

- Confirm you meet the FHOG eligibility.

- Enter into contract for a qualifying property within WA’s set limits.

- Apply for the First Home Owner Grant before or at settlement.

- Apply for stamp duty concession or waiver through RevenueWA providing needed documents.

- If you pay full duty upfront, lodge a reassessment for refund upon grant approval.

- Keep copies of all forms and correspondence for records.

Integrating Stamp Duty Waiver into Your Home Loan Strategy

Stamp duty savings can boost your borrowing power by reducing the amount you need upfront.

By working with a home loan broker Perth, you can tailor your loan to reflect the lowered initial costs, negotiating better terms or allocating more to property value.

For example, this allows first home buyers in suburbs like Baldivis or Wellard to increase their home buying budget or reduce the deposit needed.

Insightful Video: Australia’s 2025 First Home Buyer Grants – State-by-State Guide!

To deepen your understanding beyond stamp duty waivers, here is a detailed video overview of first home buyer grants across Australia, including Western Australia’s schemes:

FAQs About Stamp Duty Waiver WA

- Can I get a stamp duty waiver if I am not a first home buyer?

- No, the FHOR is specifically designed for first home buyers meeting the grant criteria.

- What if my property value is over $750,000?

- The waiver caps at $750,000 for homes south of the 26th parallel, so higher-value properties pay the general rate, although partial concessions may sometimes apply.

- Do I have to apply for the waiver before settlement?

- It is best to apply before or at settlement; otherwise, duty is charged at the general rate upfront but can be reassessed later.

- Does the waiver apply to vacant land purchases?

- Yes, if you contract to build a home on the land and meet the FHOG eligibility.

- Is foreign transfer duty affected by the waiver?

- No, foreign transfer duty is still chargeable on foreign persons’ share even if the first home owner rate applies.

What to Watch Out For and Future Updates

As legislation and market conditions evolve, always verify current thresholds, eligibility criteria, and application procedures.

Keep an eye on announcements from Western Australian Government RevenueWA and industry bodies like REIWA.

This vigilance can prevent missed opportunities or unexpected costs in your home buying journey.

Internal and External Resources for Further Guidance

- Explore our detailed guides focused on mortgage broker Baldivis and home loan broker Rockingham to align your stamp duty waiver with local market insights.

- Visit WA Government’s transfer duty exemption page for official application details.

- Check out related financial topics such as low deposit home loans in Perth to complement your home buying strategy.

Final Thoughts on Stamp Duty Waiver WA

Stamp duty concessions in WA are designed to make your entry into the property market more affordable and manageable.

By understanding the eligibility, legislative updates, application procedures, and how these concessions interact with other grants and loans, you position yourself to maximise savings and smooth the path to home ownership.

Seek local expertise, stay informed with official sources, and incorporate these benefits in your broader financial plan to make the most of the stamp duty waiver WA offers.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your home buying plans? For personalised advice, contact us!