TL;DR: The first home buyers grant WA offers up to $10,000 to eligible buyers of new homes, with no income test. Here’s a deep dive into eligibility, application, benefits, and what you need to know to maximise your home buying journey in WA.

Everyone knows the first home buyers grant WA makes owning your first home easier.

But what are the exact details and how can you qualify?

This article is your complete guide to everything about the first home buyers grant in Western Australia—consider it your cheatsheet.

Some are unaware the grant only applies to new homes or substantially renovated properties.

Some think income tests apply, but the FHOG doesn’t have any.

Some wonder what the deadline is to apply or what documents are needed.

Some are curious about how this grant affects stamp duty and other costs.

Let’s dive right in.

What Is the First Home Buyers Grant WA and How Does It Work?

The First Home Owner Grant (FHOG) in WA is a one-off government payment of up to $10,000 designed to help people buy or build their first new residential home. Unlike some other support schemes, this grant has no income or asset tests, making it broadly accessible to first time home buyers in WA.

However, it’s important to note that the FHOG only applies when purchasing a new home, a substantially renovated home, or building a new home. Established homes don’t qualify for this grant. To determine whether your property qualifies, you need to check if the home has undergone substantial renovations or is a brand-new build according to government definitions.

This grant provides a cash contribution that goes directly towards your home purchase costs, effectively reducing the initial financial burden. For many in suburbs like Baldivis, Rockingham, Port Kennedy, or Wellard, this can make a significant difference in affording a new home.

Application for the FHOG must be made within 12 months of the completion date, which is typically the date of settlement or when the building is ready for occupation.

For detailed eligibility and application requirements, you can visit the official WA Government FHOG page.

Who Is Eligible for the First Home Buyers Grant WA?

Eligibility criteria are straightforward, but there are essential conditions you must meet:

- You must be a first home buyer and not have owned a residential property anywhere in Australia before.

- You or your spouse/de facto partner cannot have previously received the FHOG.

- The purchase contract must be for a new or substantially renovated home, entered into on or after 1 July 2000.

- The home must become your principal place of residence within 12 months of completion and you must occupy it for at least six continuous months.

- The total property value must not exceed capped amounts that vary by location within WA.

Notably, the grant is not means-tested, so your income or assets will not affect eligibility. However, you can’t claim the grant more than once, and it’s designed only for owner-occupied homes, not investment properties.

Each applicant must satisfy the residence requirements to avoid having to repay the grant, which includes occupying the home for the required period.

Some applicants act as trustees for persons with legal disabilities; in these cases, the person for whom the home is purchased must meet eligibility criteria.

For more on eligibility and commonly asked questions, see the application and lodgement guide.

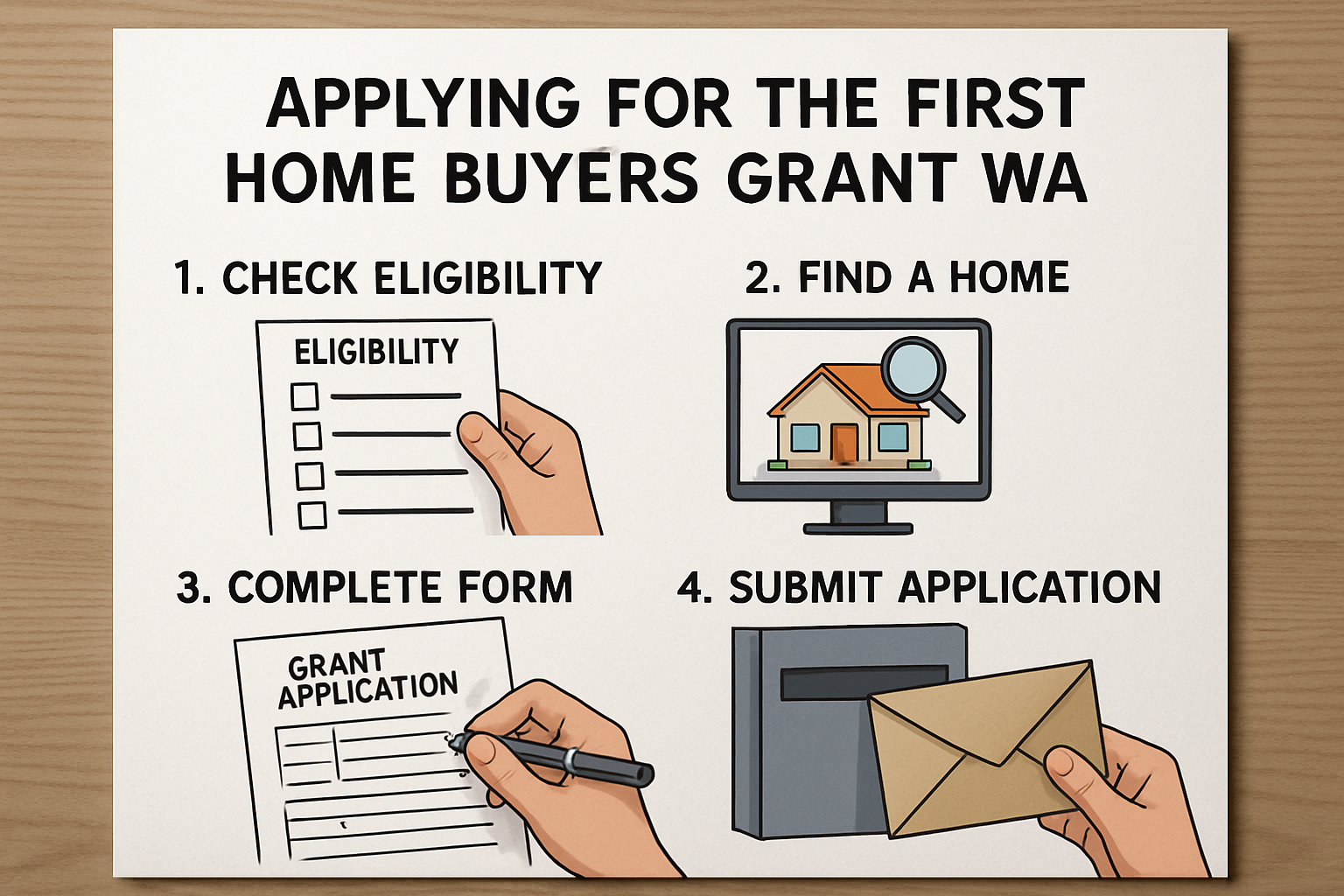

How to Apply for the First Home Buyers Grant WA

Applying for the FHOG is a straightforward process but requires timely action. Applications must be lodged within 12 months of settlement or completion of your new home.

Most applicants complete their application online through the FHOG Application Portal. This portal allows you to submit necessary documentation, including proof of purchase, occupancy plans, and identity verification.

If you are financing your home purchase with a loan from a financial institution whose lender is an approved agent, they may lodge your application on your behalf. It’s a good idea to check with your lender if they offer this service to speed up your grant processing.

Late applications cannot be accepted, so keeping track of the deadlines is crucial.

What Other Benefits Can First Home Buyers in WA Access?

Besides the FHOG, first home buyers in WA may be eligible for:

- First Home Owner Rate of Duty: A concessional stamp duty rate that applies when buying new or vacant land intended for building your first home. This lowers upfront costs considerably.

- Home Loan Options: Various government-backed loans are available, such as Keystart, which offer low deposit loans specifically tailored for first-time buyers.

- Other Subsidies and Incentives: Occasionally, federal and state government programs like the First Home Guarantee or regional grants may apply.

Understanding these options can enhance your financial strategy when entering the property market.

If you want more localised advice tailored for areas like Baldivis and Rockingham, consulting a mortgage broker in WA can provide personalised loan options and grant assistance. Check out our guide on Mortgage Broker Baldivis: Your Complete Guide to Easy Home Financing.

How Does the FHOG Affect Your Home Loan and Financial Planning?

Receiving the first home buyers grant WA can influence your home loan strategy in several ways:

- Lower Deposit Requirement: Since the grant effectively adds to your down payment, it may help you reach your loan-to-value ratio targets faster.

- Reduced Loan Amount: By decreasing the loan principal, your monthly repayments could be more manageable.

- Improved Borrowing Power: A larger upfront payment might allow you to access better interest rates or loan features.

Expert Tip: Using the FHOG alongside low deposit home loans in Perth can create a powerful combination for first home buyers. Learn more by reading our article on Low Deposit Home Loans Perth: Your Complete Guide to Buying with Just 5% Down.

Did you know? Using the grant strategically can even enable you to refinance later when mortgage rates are lower, further reducing your repayments. Consider this a long-term saving strategy.

What Are the Common Pitfalls to Avoid with the FHOG?

Many first home buyers get caught out by misunderstandings about the FHOG. Keep an eye on these common issues:

- Missing the Application Window: Applications must be submitted within 12 months of completion. Late submissions are rejected.

- Failing Residence Requirements: You need to occupy the home continuously for six months within the first year. Failure to do so may require repayment of the grant.

- Buying Established Homes: The grant is not applicable for older, established homes, only new or substantially renovated properties.

- Overlooking Stamp Duty Caps: Property value limits affect eligibility for duty concessions alongside the FHOG.

For more on managing your stamp duty obligations as a first home buyer, see our in-depth look at Understanding Stamp Duty Waiver WA: What First Home Buyers Need to Know.

Have you accounted for unforeseen delays? If you cannot meet residence conditions due to unforeseen circumstances, you must notify RevenueWA within 30 days to avoid penalties.

How Does the First Home Owner Grant WA Fit into Wider Government Housing Policy?

Government grants like the FHOG are designed to stimulate home building and ownership, which have significant economic and social impacts. Recent Reserve Bank commentary acknowledges these grants help boost demand and support the construction sector, although they also influence housing prices.

During the COVID-19 pandemic, such subsidies temporarily increased the number of first home buyers, affecting not just ownership rates but also rental markets, with more people moving from renting or sharing houses to owning new homes.RBA insights on subsidies and market effects.

At the same time, supply constraints in WA’s housing market, including Baldivis and Rockingham, mean demand fueled by grants must be matched with realistic expectations about build times and costs.

Can the FHOG Be Combined with Other First-Home Buyer Schemes?

Yes. The FHOG can often be combined with other government schemes such as the First Home Guarantee, which provides a lower deposit requirement with the government guaranteeing the remainder to lenders.

This combination can be powerful for WA buyers, enabling them to secure a home with minimal upfront cash, but it’s crucial to understand the specific eligibility conditions and how these schemes interact.

Consulting a home loan broker can unravel these complexities. For example, a home loan broker Perth can help navigate blends of grants, loans, and stamp duty concessions to suit your financial situation.

What Are the Steps to Take Right Now to Secure Your FHOG and Home Loan in WA?

Here’s your action plan as you start your journey:

- Confirm Eligibility: Ensure you meet the first home buyer and property requirements for FHOG.

- Choose Your Property Wisely: Look at new builds or substantially renovated homes in approved regions.

- Engage a Mortgage Broker: Get personalised support for loan options and grant applications.

- Prepare Your Documents: Gather contracts, ID, loan approval documents, and proof of residency plans.

- Submit Your FHOG Application Early: Use the online portal or authorised lending agents to ensure on-time lodgement.

- Plan for Occupancy: Make sure to live in the home as required to avoid repayment obligations.

Applying early and smartly will maximise your chances of securing the grant and reduce stress during the home buying process.

Common Questions About the First Home Buyers Grant WA

Q: Can I claim the FHOG if I’m building a home as an owner-builder?

A: Yes, if you start building the home on or after 1 July 2000 and meet all other eligibility criteria, you can claim the grant as an owner-builder.

Q: What is the maximum property value to qualify for the FHOG in WA?

A: The capped amounts vary by location and property type. Check the latest government guidelines to confirm these thresholds.

Q: Is the FHOG taxable income?

A: No, the FHOG is a government grant and is not considered taxable income.

Q: What if I cannot meet the six months residence requirement?

A: You must notify RevenueWA within 30 days of the end of the 12-month take-up period or as soon as you know you will not meet it, or you risk repayment with penalties. Exceptional circumstances may be considered for variations.

Understanding the First Time Home Buyer Grant in 2025

FAQ About First Home Buyers Grant WA

- How long does it take to get the first home buyers grant?

- Once your application is submitted correctly and all documents are verified, approvals usually occur within a few weeks.

- Can I apply for the FHOG if I’m buying off-the-plan?

- Yes. If the contract was entered into after 1 July 2000 and meets the new home criteria, you can apply.

- Is the FHOG available to non-residents?

- No. You must be an Australian citizen or permanent resident and the home must be your principal place of residence.

- Does the FHOG reduce my stamp duty?

- Not directly, but first home buyer concessions are available in WA that reduce stamp duty, which can be accessed alongside the FHOG.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your home buying journey? For personalised advice, contact us!

For further insights on navigating home loans and first home buyer options in Western Australia, explore our detailed guides such as Navigating First Home Buyer Loans in Perth: A Detailed Guide for New Buyers.

And if you’d like to understand how low deposit loans can work alongside grants like FHOG, check out our comprehensive article on Low Deposit Home Loans Perth.

Remember, securing a home with the first home buyers grant WA is just the beginning. A mortgage specialist can help you plan the entire financing journey efficiently, making your dream home a reality in suburbs like Rockingham, Port Kennedy, or Wellard.

(Verified with sources as of 2025-08-31)

References:

- WA Government First Home Owner Grant Information

- Application Guide for WA FHOG

- Reserve Bank of Australia insights on housing grants

- Mortgage Broker Baldivis guide

- Low Deposit Home Loans Perth guide