A large share of Australian home loans are arranged through a mortgage broker.

But what are they, exactly?

In this professional, actionable guide, you’ll get the complete Perth home loan broker playbook, including a step-by-step checklist, suburb-level tips, and WA concessions.

Some are deeply connected to WA lender policies and know how to position FIFO or contractor income.

Some are exceptional at structuring offsets and splits that protect your cash flow.

Some are rapid operators with document-ready systems that trim days off approvals.

Some are negotiators who can secure sharper pricing without compromising policy fit.

Some are specialists in construction loans, bridge finance and debt consolidation for Perth households.

Some are locals who know Baldivis, Rockingham, Port Kennedy and Wellard street by street.

Let’s dive right in.

Table of contents

- Home loan broker Perth: why local expertise matters

- How a Perth broker works from discovery to settlement

- Perth and WA context: market, APRA settings, Keystart and FHOR

- Step-by-step roadmap to a smooth approval

- Choosing your broker: credentials, questions and red flags

- Loan types and features explained for WA buyers

- All WA costs to budget for

- Refinancing with a Perth broker

- Perth-specific mini case studies

- Advanced tips for competitive Perth markets

- Micro-guides for Baldivis, Rockingham, Port Kennedy and Wellard

- Glossary of loan terms

- FAQs

- Next steps: your action checklist

Home loan broker Perth: why local expertise matters

If you’re weighing up whether to engage a home loan broker perth, consider this: approvals aren’t won by a headline rate alone. They’re won by policy fit, timing, and structure. Especially in WA.

A Perth-based broker blends three advantages:

- Market fluency: Perth cycles, constrained construction capacity, and tight advertised stock shift how lenders prioritise deals.

- Policy alignment: FIFO allowances, overtime, and contract roles need careful presentation to lenders that credit them fairly.

- Execution under WA timelines: finance clauses, settlement practices, and valuation quirks in specific suburbs can make or break an offer.

That’s the difference between an application that meanders and an application that lands with the right lender, at the right time, with the right structure.

Here’s what that looks like in practice.

How a Perth broker works from discovery to settlement

Discovery: goals, timing, and borrowing power

Your journey starts with a short discovery call. Clarity first. Are you buying a first home, upsizing, building, investing, or consolidating debts? What’s your timeframe? What suburbs are on the table—Baldivis, Rockingham, Port Kennedy, Wellard, or Perth-wide?

Next, your broker gathers data: income, allowances, bonuses, overtime, debts, credit limits, savings history, living costs, and any planned changes. They run pre‑assessment through lender serviceability calculators. These build in a stress rate, usually several percentage points above your expected rate. APRA’s macroprudential frameworks—such as the use of a serviceability buffer—are designed to keep lending resilient through the cycle, and settings are reviewed alongside risk and credit growth conditions (APRA Chair speech).

Outcome: a realistic borrowing range, policy flags, and a shortlist of suburbs where your budget competes.

Research: shortlisting lenders for policy fit

Now the heavy lifting. Your broker canvasses a broad lender panel. Rate matters, but policy fit determines if you’re approved. They examine:

- Minimum deposit and LVR tiers, including LMI brackets.

- Treatment of overtime, shift penalties and FIFO allowances.

- Genuine savings requirements and use of gifts/guarantors.

- How rental income and negative gearing are assessed.

- Turnaround times and the bank’s appetite for your property type (new build, strata, regional fringe, small apartment).

Expect 2–3 strong options with clear pros and cons. Headline rates are compared with true cost over 3–5 years, including fees, offsets, and anticipated repricing windows.

Advice: designing a structure that protects cash flow

Structure is your silent advantage. Examples:

- An offset account linked to a variable split to park salary and emergency funds.

- A split loan: part fixed for stability, part variable for flexibility and offset access.

- Interest‑only terms for investors (where appropriate) to improve cash flow.

- Multiple offsets for portfolio growth (common for Perth investors scaling to a second or third property).

Good structure = fewer surprises, more optionality. It’s the foundation for fast debt reduction or smooth expansion.

Execution: pre-approval to settlement

Once you lock in a plan:

- Your broker packages the application and supporting docs.

- Submission to the chosen lender and credit assessment.

- Valuation (ordered by the lender) and condition clearance.

- Unconditional approval, loan docs, insurance, settlement coordination with your settlement agent.

Turnaround times vary by lender and workload. A tidy, well‑documented file moves faster.

After‑settlement care: repricing and refinancing windows

Your broker should monitor your loan. When market pricing shifts, they request a reprice. When sharper products or incentives appear, they flag refinancing windows and model the break‑even. That’s how you stay competitive without the DIY admin.

Perth and WA context: market, APRA settings, Keystart and FHOR

Market dynamics: stock, demand, and sentiment

Perth has run lean on advertised stock at various points, with migration and household formation underpinning demand. When listings are scarce, approvals need to be tight, valuations need to be anticipated, and contract dates must be managed with precision. Recent national housing updates also point to improving sentiment as rate‑cut expectations build and inventory remains below multi‑year averages. Research houses tracking national and capital‑city trends have highlighted that Perth continues to be among the country’s pace‑setters over multi‑year horizons, supported by constrained new supply and resilient labour conditions (Cotality Research).

Risk settings: what APRA means for you

Australia’s regulators keep an eye on household debt and credit quality. APRA regularly considers macroprudential tools—like serviceability buffers and limits on riskier lending—to keep the system safe while sustaining credit flow. As of mid‑2025, APRA noted it is maintaining settings while remaining alert to future risks if rates fall and risk appetite rises (APRA Chair speech). Translation for borrowers: lenders will continue to test your repayments at a “stress rate” above your actual rate. The stronger your documentation and living‑expense evidence, the better your outcome.

Keystart updates: bigger windows for eligibility

Keystart is a uniquely WA pathway that can enable purchases with smaller deposits and no Lenders Mortgage Insurance (LMI). In July 2024 the WA Government lifted Keystart’s property price and income limits to reflect rising costs, with Low Deposit Home Loan property caps moving from $560,000 to $650,000 and income limits for singles up to $137,000 and couples/families to $206,000 (statewide except the Kimberley and Pilbara which are reviewed separately) (WA Govt: Keystart changes). Your broker will assess whether Keystart or a mainstream lender is better for your long‑term goals.

First Home Owner Rate (FHOR) changes from March 2025

From 21 March 2025, WA increased thresholds for the First Home Owner Rate of duty. For homes, no transfer duty applies at $500,000 or less; concessional rates apply between $500,001 and $700,000 in the Metropolitan and Peel regions, and up to $750,000 outside those regions. For vacant land, no duty applies at $350,000 or less; concessional rates apply between $350,001 and $450,000. Transactions after 21 March 2025 that settle before implementation may be reassessed for a refund (RevenueWA: FHOR and off‑the‑plan changes). Confirm eligibility, timing, and documentation early so your contract dates and finance clause align.

Pro tip: pair FHOR with a lender that offers a sharp owner‑occupier rate and a genuine 100% offset. The duty saving plus interest savings is a double win.

Step-by-step roadmap to a smooth approval

Step 1: Get borrower‑ready (credit hygiene and deposit)

- Target a deposit that lands on a favourable LVR tier. 20% avoids LMI; 10–15% plus LMI can be efficient; Keystart or federal guarantees can reduce upfront hurdles for eligible buyers.

- Stabilise your accounts 90 days out. Reduce credit limits, cancel unused cards, avoid BNPL, and ensure all bills auto‑pay on time.

- Document genuine savings with clean bank statements. If gifts or grants are involved, disclose early.

Step 2: Calculate borrowing capacity (stress tests, HEM)

Lenders assess affordability with a stress rate above your actual rate and benchmark your living expenses against HEM. Your broker will reconcile your real spending with bank statements and identify any expenses that can be evidenced as temporary. Put simply: accurate inputs = fewer surprises at credit.

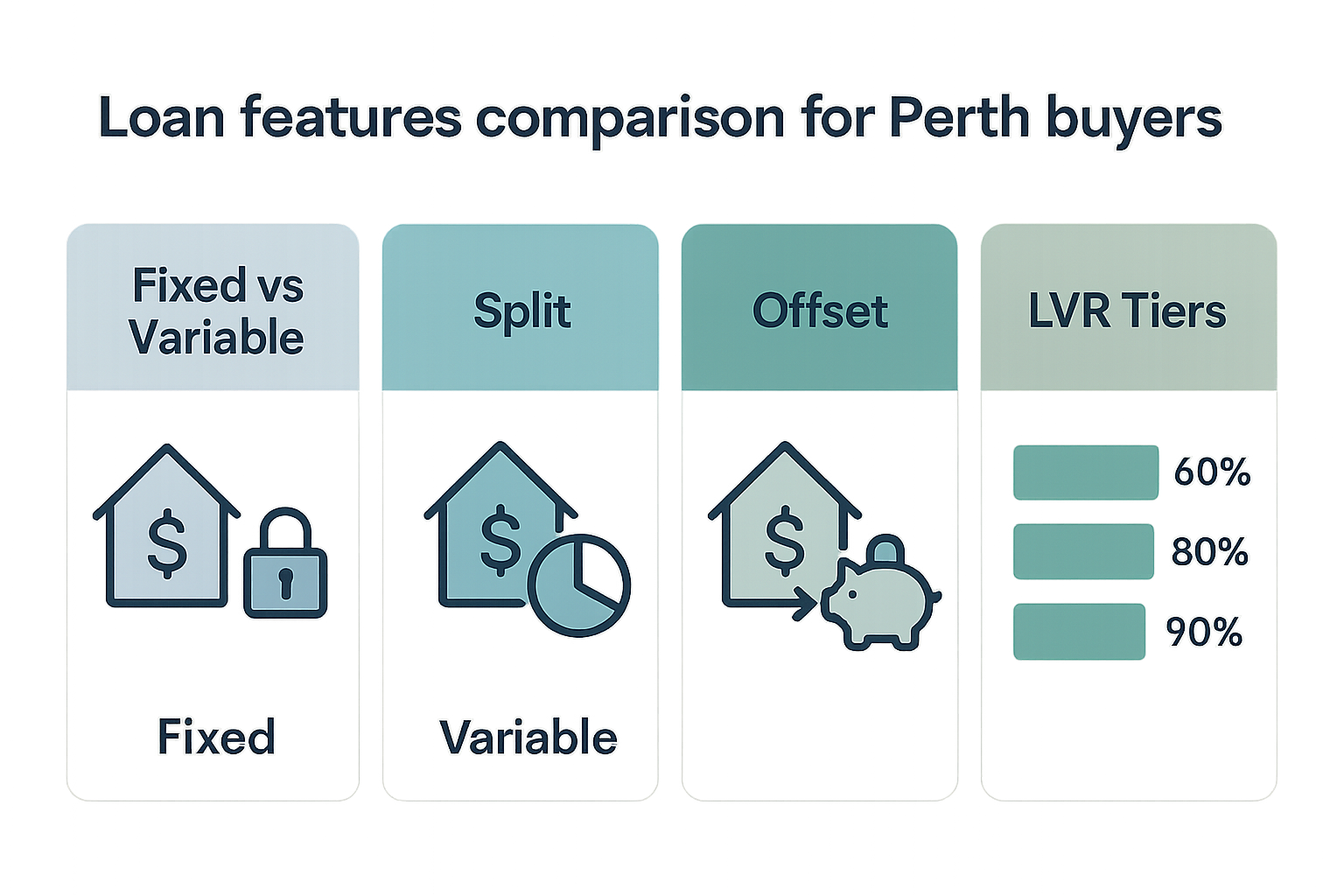

Step 3: Choose your strategy (fixed, variable, split, offsets)

- Fixed: payment certainty but limited flexibility and potential break costs.

- Variable: flexible with extra repayments and offset access.

- Split: hedge rate risk—fix a portion, keep a portion variable with offset.

- Offset vs redraw: offset preserves interest savings with easy access; redraw can be cheaper but may have access limits and tax implications for investors.

Step 4: Documents checklist

- ID: driver licence, passport, Medicare.

- Income (PAYG): 2–3 payslips, employment letter, end‑of‑year summary, bank statements.

- Self‑employed: 2 years tax returns and notices of assessment; BAS; in some cases, alt‑doc options via BAS/business bank statements/accountant letters.

- Savings: 3–6 months statements showing deposit build‑up.

- Debts: statements for cards, personal loans, car loans, HELP.

- Extras: rental history, child support documents, eligibility evidence for FHOG/FHOR/guarantee schemes.

Step 5: Nail the pre‑approval

Insist on a credit‑assessed pre‑approval, not just a system tick. Typical validity is ~90 days. Clarify any property restrictions (small apartments, high‑density postcodes, specialty constructions), and understand auction rules (no finance clause). Keep your finances steady—no big new debt, no job changes if avoidable.

Step 6: Offer, valuation, and shortfalls

Use a subject‑to‑finance clause unless at auction. When the lender orders a valuation, it may come in below your contract price. Options if short:

- Tip in more cash if feasible.

- Have your broker challenge the valuation with evidence, or request a second valuation if policy allows.

- Pivot to another lender aligned with a different valuation panel, if timelines allow.

Step 7: From unconditional to settlement

Sign loan docs promptly, arrange building insurance (required from settlement, often earlier for houses), and coordinate duty and titles with your settlement agent. Final inspection, settlement day funds, keys. Done.

Choosing your broker: credentials, questions and red flags

Regulation 101 and best interest duty

In Australia, mortgage brokers operate under an Australian Credit Licence (ACL) or as authorised representatives. They’re expected to meet their best interest duty when recommending credit assistance. Industry membership (MFAA or FBAA), appropriate qualifications, and external dispute resolution arrangements are standard. If you’re curious about entry pathways, industry training providers outline the accreditations, bank onboarding and compliance components that brokers must meet to access lender panels and remain compliant with ASIC expectations.

Smart questions to ask

- Panel and policy: which lenders frequently suit WA borrowers with my income and employment profile?

- Turnaround times: which lenders are moving quickly this month?

- True cost: can you compare options over 3–5 years including fees, offsets and likely repricing?

- Post‑settlement: will you diarise repricing requests and review my rate annually?

- Government schemes: can you test me for Keystart, guarantees and FHOR benefits?

Red flags

- One‑lender push without a policy reason.

- No written credit proposal outlining why the recommendation suits you.

- Vague on fees, comparison rate, or policy constraints.

Want to dig deeper into how to compare options and read market updates? Browse our blog hub for Perth loan insights for practical explainers and suburb‑level commentary.

Loan types and features explained for WA buyers

Owner‑occupier vs investor lending

Owner‑occupier loans typically price lower than investor loans. Investor assessments may treat rental income and negative gearing differently. If you plan to borrow again, prioritise flexibility: multiple offset accounts, uncapped extra repayments on variable splits, and transparent refinance policy.

Fixed vs variable vs split

Rising living costs and build timelines have made payment certainty attractive for many Perth households. A split structure can provide the middle path: fix a portion for predictability and keep a variable portion with offset for agility. If you expect a sale or refinance early, consider the risk of fixed‑rate break costs.

Offset and redraw

An offset account reduces interest by netting your cash against your loan balance, while keeping funds accessible. Redraw lets you pull out extra repayments but may have access rules. For investors, tax outcomes can be influenced by how you move funds in and out—get tax advice before implementing any debt recycling or redraw strategies.

LVR, LMI, and low‑deposit pathways

Lenders Mortgage Insurance (LMI) is a premium allowing lower deposits at higher LVRs, typically above 80%. It can be capitalised into the loan. Federal guarantees and Keystart can reduce or remove LMI for eligible buyers, but each comes with eligibility criteria, price caps and policy trade‑offs. Model both pathways: “buy now + LMI or guarantee” versus “wait for 20% deposit.”

Self‑employed solutions

Two years of financials yields the widest lender choice. If that’s not feasible, some lenders offer alt‑doc solutions using BAS, business bank statements or an accountant’s letter. Expect tighter LVRs and a rate premium. A specialist broker will weigh cost versus timing and ensure responsible lending obligations are met.

All WA costs to budget for

Transfer duty and FHOR

For eligible first‑home buyers, WA’s FHOR can substantially reduce duty. From 21 March 2025, homes up to $500,000 pay no duty, with concessional rates up to $700,000 in the Metro and Peel regions, and up to $750,000 outside those regions. For vacant land, no duty up to $350,000, concessional to $450,000. Timing matters—some contracts that settled before systems updated may be reassessed for refunds (RevenueWA announcement).

Settlement agent/conveyancer fees

WA settlement agents coordinate contract reviews, duty lodgement, title searches and settlement. Obtain a quote that clarifies inclusions (strata searches, special conditions, council inquiries). A few hundred dollars spent on deeper searches can avert costly surprises.

Inspections and reports

For houses: building and pest. For strata: records, minutes, financials, special levy history. If issues emerge, schedule re‑inspections and negotiate repairs or price adjustments.

Lender fees and ongoing costs

Application, settlement and valuation fees vary; many lenders waive some fees in campaigns. Package fees may be worthwhile if they unlock sharper pricing and multiple offsets. Always compare total cost over 3–5 years, not just the fee line item.

Ownership costs

Budget for council and water rates, strata levies (if applicable), building/contents insurance, utilities, and a maintenance reserve (1–2% of property value annually is a conservative buffer for established homes).

Refinancing with a Perth broker

When it makes sense

- Your rate is no longer competitive and repricing didn’t deliver enough.

- Your fixed term is ending and you want a new structure (offsets, splits, consolidation).

- Your equity has grown, opening lower LVR pricing and removing LMI loading.

- You’re planning renovations or acquiring an investment and need an equity release.

Cashbacks vs lasting value

Cashbacks look tempting, but a slightly higher rate can erase the benefit in 12–18 months. Your broker should calculate the break‑even considering discharge fees, application fees, and any fixed‑rate break costs.

Equity releases

For renovations, consider a separate split to preserve clear deductibility lines if you later invest. For an investment deposit, keep personal and investment debt clean. Precision here makes your accountant smile.

Curious which lenders are pricing aggressively this quarter and which are moving quickly? Skim our latest articles index for time‑sensitive updates and campaign watch‑outs.

Perth-specific mini case studies

Lucy, first‑home buyer leveraging FHOR and a sharp offset

Lucy is a nurse renting in Joondalup with a 9% deposit and a solid savings pattern. Her broker mapped three paths:

- Wait for 20% deposit to avoid LMI (time cost: rising rents).

- Buy now at ~91% LVR with LMI; choose a lender with competitive OO variable and offset.

- Use an eligible guarantee to avoid LMI altogether.

Given Lucy’s stable income and rising rents, option 3 won. She targeted a townhouse within FHOR thresholds, trimming duty, and the offset preserved her emergency fund. The structure left room for extra repayments without locking her in.

Mark, FIFO electrician—policy fit boosts capacity

Mark works a 2/1 roster with strong base pay and regular overtime. Some lenders shaded variable income too heavily, constraining borrowing capacity. His Perth broker shortlisted lenders accepting 12 months of overtime and allowances at more realistic weightings, verified through payslips and group certificates. The policy difference added six figures of usable capacity. He bought a four‑bed in Baldivis with a plan to add a granny flat later (subject to local planning and rental yield modelling).

Priya and Sam, upsizers with a bridge loan

They owned in Morley with substantial equity but needed to buy before selling. Their broker arranged a bridging facility assessed on end debt rather than peak debt, keeping repayments manageable. They secured the new home, sold in eight weeks, then converted to a competitive variable with offset and a modest fixed split.

Claire and Ethan, Port Kennedy investors—yield and buffers

A couple targeting Port Kennedy for yield and beach‑adjacent lifestyle. Their broker modelled conservative rent, 6‑month vacancy risk over a decade, and rates 2% above current. The portfolio plan used multiple offsets to isolate property cash flows. They secured an investor loan with acceptable assessment of negative gearing while preserving borrowing power for a second asset.

Amir, Wellard construction—progress payments and builder comfort

Amir chose a new build in Wellard. His broker vetted lenders comfortable with WA standard building contracts and confirmed how valuations would be handled (on‑completion) and whether the fixed‑rate option applied during construction (it didn’t). The loan funded slab, frame, lock‑up, fix, and completion stages with predictable drawdown timing.

Advanced tips for competitive Perth markets

Make your pre‑approval bankable

Not all pre‑approvals are alike. A fully assessed pre‑approval—with credit verified—gives agents confidence. Have your broker provide a summary that confirms assessment status. Keep your documents in a single, dated PDF package. Speed matters when stock is scarce.

Auction strategy and deposit logistics

Auctions have no finance clause. Test multiple lender calculators, consider valuation risk ahead of time, and have the 10% deposit logistics nailed—bank cheque or trust account. If your bank transfer limits could delay funds, set this up in advance.

Building in WA

Understand progress claims and lender inspection timings. Confirm how variations are treated. Check whether your fixed‑rate option can be used during construction—many can’t. Ask your broker to map the timeline against your rental lease to avoid double‑housing costs.

Using Keystart or guarantees in a hot market

Some sellers don’t understand Keystart or guarantees. Your broker can brief the agent on process and certainty, and craft finance clauses that are realistic without scaring vendors. Policy alignment plus communication wins offers.

Want a structured overview of services and pathways you can consider? See our services overview to plan a pathway that fits your goals and timeframes.

Micro-guides for Baldivis, Rockingham, Port Kennedy and Wellard

Baldivis: family‑friendly growth and new‑build options

- Profile: family homes, new estates, solid owner‑occupier demand.

- Finance tip: construction loans are common—confirm builder acceptance and progress valuation policies early.

- Valuation watch: estates with many similar properties can see tight valuations; keep buffers.

- Loan pick: split structure with an offset to handle build variations and furnish the new home without credit creep.

Rockingham: lifestyle buyers and mixed stock

- Profile: coastal lifestyle, apartments and houses; investor interest in selected pockets.

- Finance tip: some lenders are cautious on small apartments; pre‑vet building size and complex.

- Valuation watch: beach‑adjacent premiums; ensure comparable sales support your offer.

- Loan pick: owner‑occupier variable with offset for aggressive extra repayments if you plan to upgrade within 3–5 years.

Port Kennedy: yield hunters with an eye on maintenance

- Profile: houses with yard space; appealing to renters and families.

- Finance tip: forecast maintenance; set aside a sinking fund in your offset.

- Valuation watch: check any prior termite history with thorough pest inspections.

- Loan pick: investor loan with multiple offsets to separate rental income and expenses.

Wellard: transit‑linked growth and construction pipelines

- Profile: train access, new estates, mixed stock.

- Finance tip: if choosing a new build, check lender appetite for your builder and contract type.

- Valuation watch: on‑completion valuations—ensure spec level matches valuation assumptions.

- Loan pick: staged draw construction facility; roll to a split with offset on completion.

Want to see how similar buyers navigated these suburbs? Browse our client case studies to benchmark scenarios and outcomes.

Glossary of loan terms

- LVR (Loan‑to‑Value Ratio): loan amount divided by property value.

- LMI (Lenders Mortgage Insurance): premium that protects the lender at high LVRs.

- Offset account: transaction account that reduces interest by offsetting your loan balance.

- Redraw: access to extra repayments made above the minimum.

- Comparison rate: interest rate including most fees expressed as a single figure.

- Serviceability buffer: extra margin used to test your capacity to repay under higher rates, part of macroprudential risk management (APRA overview).

- Conditional approval: support subject to conditions (e.g., valuation).

- Unconditional approval: full approval; all conditions met.

- Settlement: legal transfer of property and funds.

FAQs

Do I pay a broker fee?

Most brokers are remunerated by lenders via commissions. In complex scenarios, some brokers may charge a client fee. Ask upfront so you know the total cost picture.

Is the lowest rate always the right choice?

Not necessarily. If the policy doesn’t fit—say, your overtime is heavily shaded—you may be declined even with a lower headline rate. Compare the true cost over time and the likelihood of approval.

How long does pre‑approval take in Perth?

Anywhere from 24 hours to two weeks depending on lender workload, your scenario, and how complete your documents are. Your broker will target lenders with fast current turnarounds if timing is tight.

Can a broker help with Keystart or federal guarantees?

Yes. Many Perth brokers work with Keystart and federal guarantees and can assess eligibility and timing relative to your contract dates (WA Govt: Keystart).

What if the valuation comes in low?

Your broker can challenge with evidence, seek a second valuation where policy allows, or pivot to a lender with a different valuation panel. You can also renegotiate price or add to your deposit.

Are FIFO incomes harder to approve?

They can be, but the right lender policy makes the difference. A local broker can shortlist lenders that treat allowances and overtime more favourably with sufficient history.

Can I refinance soon after settlement?

You can, but consider fixed‑rate break costs, discharge fees and whether repricing with your current lender achieves similar savings. Many brokers review loans 6–12 months post‑settlement.

Next steps: your action checklist

- Define your goal and budget: owner‑occupier or investor, target suburbs, time horizon.

- Clean up your profile: reduce unsecured debts, lower credit limits, stabilise accounts.

- Collate documents: ID, income, savings, debts, statements, scheme eligibility.

- Meet a Perth broker: confirm borrowing power, policy fit and structure options.

- Secure a strong pre‑approval: credit assessed, property restrictions noted.

- Engage a settlement agent early: duty estimates and contract conditions aligned.

- Shortlist suburbs and property types: consider valuation risk and rental yields.

- Make competitive offers: subject‑to‑finance where possible; understand auctions.

- Move swiftly from conditional to unconditional: respond fast to requests.

- Prepare for settlement: insurance, final inspection, funds to complete.

- Post‑settlement: set up offsets/direct credits, diarise rate reviews, plan next steps.

Ready to meet the people who will run this process with you? Get to know our Perth team and how we collaborate with you from pre‑approval to post‑settlement care.

When you’re ready, continue by exploring structured learning paths and practical explainers via our services overview and the broader insights on our blog hub.

Evidence‑based decisions and staying current

Strong lending outcomes depend on data, policy awareness and timing. Macroprudential settings, household debt dynamics, and lender appetite shift over time. Industry commentary from prudential regulators provides context for why banks test your affordability with buffers and why approval criteria can tighten or loosen across the cycle (APRA Chair speech). WA program parameters, such as Keystart’s price and income limits, are periodically recalibrated to reflect market conditions and affordability (WA Govt: Keystart). Duty concessions for first‑home buyers can materially change your purchase budget and are subject to legislative updates (RevenueWA). Keep your plan current with quarterly reviews.

To track practical changes, scan the index of our latest articles and meet the specialists who’ll tailor the lending strategy to your scenario via our Perth team. Want real‑world results? Explore before‑and‑after outcomes in our case studies.