TL;DR: Home loan mortgage brokers in Wellard connect you with tailored financing solutions suited to your local property market. Here’s an in-depth guide on how to leverage their expertise to secure the right home loan.

Everyone knows that having the right home loan mortgage broker Wellard can make a huge difference when navigating your home financing options.

But what exactly does a home loan mortgage broker do in Wellard?

Here’s your complete cheatsheet to understanding everything about working with a home loan broker in Wellard.

Some are experts in matching you with loans that fit your unique financial situation.

Some are skilled at unlocking government grants and schemes that can lower your upfront costs.

Some specialise in helping first home buyers or property investors make smart decisions.

Some simplify complicated jargon and processes so you feel confident at every step.

Some provide tailored advice that keeps Wellard’s local property market conditions front and centre.

Let’s dive right in.

What Does a Home Loan Broker in Wellard Do?

A home loan broker in Wellard acts as your local home finance guide, matching you to lenders and products that suit your property goals and financial profile.

This means your lending adviser will:

- Assess your financial health and borrowing capacity.

- Find home loans from various banks and lenders, including options you might not encounter alone.

- Explain complex home loan terms in simple, jargon-free language.

- Support you through the application process, making sure documentation is accurate and complete.

- Help access government incentives like the First Home Owner Grant or stamp duty concessions relevant to Wellard residents.

- Advise on refinancing options to lower repayments or consolidate debt.

Working closely with a local expert ensures your loan is based on Wellard’s current market trends and lending conditions. That’s crucial given the suburb’s steady growth and increasing demand for quality homes.

How Can a Home Loan Broker Wellard Help First Home Buyers?

First home buyers face a maze of challenges: saving for deposits, understanding government grants, and navigating strict lender policies. A home loan broker Wellard gives you a clear path.

Your broker will:

- Explain the First Home Buyer Grant in WA and eligibility criteria, making sure you don’t miss out on potential savings.

- Guide you through low deposit home loans, including those with as little as 5% deposit—such as Keystart loans or special low deposit products available locally.

- Help organise your pre-approval so you know exactly what you can borrow before hunting for properties in Wellard.

- Explain the nuances of stamp duty concessions applicable for first-time buyers in Wellard.

- Set realistic budgeting expectations so your repayments fit comfortably within your income.

These steps can turn the overwhelming property search into a clear, confident journey.

Are There Specialised Loans for Investors in Wellard?

Absolutely. Many investors seek to build a portfolio of Wellard properties, whether for steady rental income or capital growth. Home loan brokers Wellard understand these needs deeply.

Your broker can help you access:

- Investment property loans designed to maximise your borrowing power.

- Loans that take into account expected rental returns, helping you qualify more easily by factoring in rental income.

- Strategies to navigate debt to income ratio limits and plan for portfolio growth.

- Refinancing options that free up equity for future investments.

- Advice on how construction loans work if you’re building new properties in Wellard’s developing areas.

Understanding these loans requires specialist knowledge that a Wellard home loan broker brings to your table.

What Are the Benefits of Refinancing in Wellard?

Interest rates and loan conditions change over time, so refinancing your Wellard home loan can unlock significant savings and flexibility.

Refinancing might help you:

- Lower your interest rate with a new lender or loan product.

- Consolidate other debts like credit cards or car loans into your home loan, simplifying repayments and potentially lowering rates.

- Access equity built in your property for home renovations or new investments.

- Switch to loans with features better suited to your current lifestyle, such as offset accounts or flexible repayment options.

- Eliminate or reduce costly fees by restructuring your loan.

Working with a broker experienced in Wellard refinancing guarantees your best local options are explored thoroughly.

Did you know? Regularly reviewing your home loan can save thousands over the life of the mortgage.

How Do I Choose the Right Home Loan Broker in Wellard?

Picking the right broker is just as important as selecting your loan. Here’s what to look for:

- Local expertise. Your broker should deeply understand Wellard’s property market and lending landscape.

- Access to multiple lenders. The best brokers have a wide panel, increasing your loan options.

- Transparent advice. Clear explanations without pressure to pick specific lenders.

- Strong communication. Prompt updates and guidance throughout the loan process.

- Positive reviews. Look for client testimonials or word-of-mouth recommendations.

Engaging with a local broker gives you the edge in a competitive market like Wellard.

Can a Home Loan Broker Wellard Help Me Navigate Government Schemes?

Yes, and this is often an overlooked advantage. Various government incentives help reduce the upfront costs of buying a home in Western Australia.

Your broker explains and assists with:

- First Home Owner Grant WA applications and eligibility.

- Stamp duty concessions and deferrals for eligible buyers in Wellard.

- Keystart low deposit home loans designed for eligible first home buyers.

- Opportunities for eligible buyers to reduce their borrowing costs and fees.

Using these schemes effectively can substantially improve your buying power and experience.

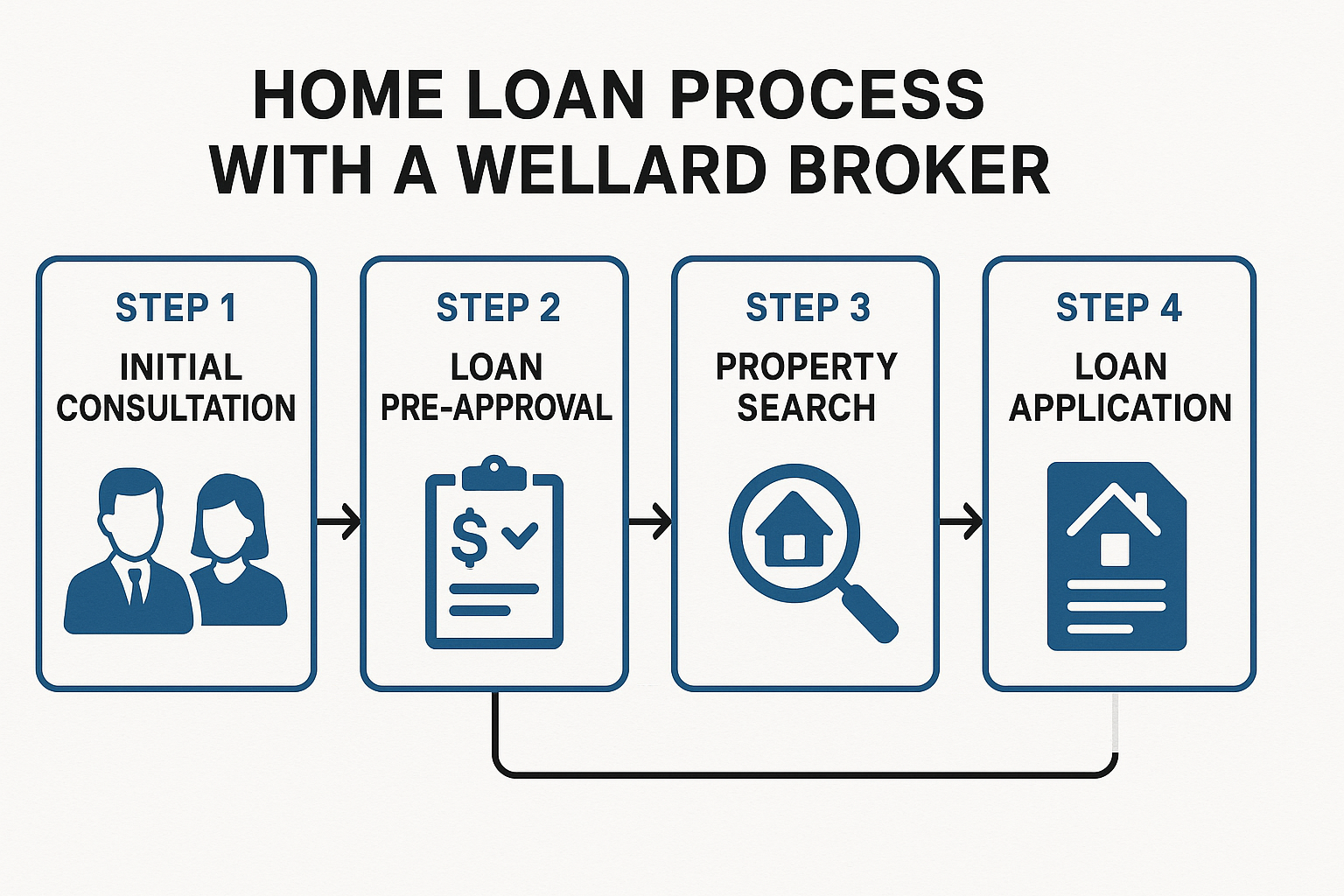

What Should I Expect During the Home Loan Application Process With My Broker?

The process is simpler and less daunting with a trusted home loan broker in Wellard guiding you.

- Initial consultation: Discussion of your financial goals, budget, and loan needs.

- Documents gathering: Your broker lists what’s needed — proof of income, ID, expenses, debts, assets, and more.

- Loan comparison: Your broker searches lender panels and recommends suitable loan products.

- Pre-approval: Your broker submits your application to lenders for pre-approval, giving you a clear borrowing limit.

- Loan application: After property selection, formal application submission and structuring.

- Settlement assistance: Your broker liaises between lenders, solicitors, and you to ensure smooth settlement.

- Ongoing support: Post-settlement help with refinancing or renegotiating your loan as needed.

Experienced brokers also track your loan’s progress to solve any unexpected hurdles swiftly.

How Do Local Market Trends in Wellard Impact My Home Loan Options?

Wellard is a rising suburb in the Perth metropolitan area, blending natural lifestyle appeal with growing infrastructure and amenities. This creates unique financing dynamics.

Some impacts include:

- Property values. Rising prices can affect deposit requirements and loan-to-value ratios.

- Development projects. New housing estates and infrastructure upgrades may offer construction loan opportunities.

- Rental market vigour. For investors, rental demand impacts rental income projections lenders consider.

- Government initiatives. Local incentives or schemes periodically adjust affecting financing terms.

Keeping abreast of these trends helps you and your broker maximise financing advantages in Wellard.

What Expert Tips Can I Follow to Get the Most from a Home Loan Mortgage Broker Wellard?

Your broker can unlock great advantages — but here’s how to get even more from the partnership:

- Be honest and upfront. Share your entire financial picture for accurate advice.

- Ask about all fees upfront. Make sure you understand broker fees, application charges, and lender fees.

- Stay responsive. The quicker you provide documentation, the smoother the process.

- Seek clarity. Don’t hesitate to ask your broker to explain anything you don’t understand.

- Explore options. Your broker should present multiple loan products — question differences clearly.

- Keep an eye on market changes. Rates and policies change quickly; your broker should update you regularly.

Following these tips keeps your financing journey clear and stress-free.

How Can I Access More Help With My Home Loan in Wellard?

If you want tailored, professional support through your home loan journey in Wellard, consider contacting a qualified mortgage broker like those at The Mortgage Suite. They have strong local expertise across Wellard and neighbouring suburbs like Baldivis, Rockingham, and Port Kennedy.

For first home buyers, investors, or experienced homeowners considering refinancing or construction loans, expert advice is just a conversation away.

Get started by exploring these helpful articles on related topics:

- Mortgage Broker Wellard: Your Ultimate Guide to Local Home Loan Solutions

- Navigating Construction Loans in Perth: What You Need to Know Before Building

- Navigating First Home Buyer Loans in Perth: A Detailed Guide for New Buyers

Each provide actionable, WA-specific insights that connect directly to your needs as a Wellard property buyer or investor.

What Are Common Mistakes to Avoid With a Home Loan in Wellard?

Learning from others’ experiences can save you time and money. These pitfalls often trip up borrowers:

- Not getting pre-approval—leading to missed property opportunities.

- Failing to disclose all debts and expenses to your broker and lender.

- Overextending your borrowing capacity without considering future financial changes.

- Ignoring government schemes or grants that could reduce costs.

- Choosing a loan based solely on interest rates, without considering fees or features.

- Not reviewing your loan after market shifts, missing out on potential refinancing savings.

Your home loan broker in Wellard helps you avoid these through expert guidance every step.

Quick Tip: Always ask your broker to provide you with a clear comparison of loan features, fees, and flexibility before deciding.

Why Is Local Knowledge Important in Home Loan Brokering?

Local insight matters whether you’re buying in Wellard or nearby suburbs like Baldivis and Rockingham. It influences:

- Loan structuring that aligns with regional market values and growth.

- Access to targeted grants and government offers for local buyers.

- Understanding of local lenders and their criteria.

- Connection with local property professionals for comprehensive support.

- Recognising shifts in market conditions affecting affordability and investment potential.

Local brokers translate these elements into advice that’s practical and tailored to you.

How Much Does It Cost to Use a Home Loan Broker Wellard?

Most home loan brokers in Wellard receive commissions from lenders—meaning no upfront fees for you in many cases.

However, some brokers may charge service fees depending on the complexity of your loan or special lending scenarios.

Always clarify costs and commissions upfront with your broker. Transparency keeps your finances clear and stress-free.

What Questions Should I Ask My Home Loan Broker Wellard?

- What lenders do you have access to, and why do you recommend certain loans?

- Can you explain all fees and charges linked to the loans?

- Do you help with government grants like the First Home Owner Grant?

- How will you support me through the loan process?

- What happens if my financial situation changes after settlement?

- Do you offer refinancing advice later on?

Getting these answers upfront empowers you to choose the best home loan and broker combination.

Conclusion: Why You Should Consider a Home Loan Broker in Wellard

A home loan broker Wellard provides the personalised advice, local insight, and access to loan products that DIY applications simply can’t match. Whether you’re a first home buyer, investor, or refinancing owner, their guidance increases your odds of securing the right loan under the best terms.

In a competitive and evolving market like Wellard, having a dedicated lending adviser by your side is a powerful advantage.

Ready to explore your options with a trusted expert? Start your mortgage journey informed and confident.

Frequently Asked Questions

How long does it take to get approval through a home loan broker in Wellard?

Generally, pre-approval can take a few days depending on your paperwork.

Are there home loans with low deposits available in Wellard?

Yes. Programs like Keystart loans and other lender products allow deposits as low as 2%, ideal for first home buyers. Your broker can explain eligibility and help you apply.

Can I refinance my Wellard home loan with a broker?

Absolutely. Brokers track current rates and loan products, helping you find refinancing opportunities to reduce repayments or consolidate debts effectively.

What documentation will I need to provide?

Expect to provide proof of income, identification, bank statements, expenses, debts, and details of the property. Your broker will give you a detailed checklist.

How do brokers get paid?

Most brokers receive commissions from lenders for successful loans. Some may charge a fee—always discuss this upfront to avoid surprises.

What’s Your Next Step?

For personalised advice, contact us!

Want to learn more about navigating home loans in Western Australia? Check out this detailed Home Loan Broker Perth guide for broader insights tailored to the WA market.

For first home buyers, discover how to boost your entry with low deposit strategies in Low Deposit Home Loans Perth.

Investors can deepen their knowledge with our article on Investment Home Loans in Perth, offering strategic tips to maximise property financing.

Explore more insights on first home buyer grants and local government schemes at How First Home Buyer Grants in WA Can Support Your Property Journey.

And for savvy bookkeeping advice to manage your property finances, check out this resource on how to automate bookkeeping and optimise your cash flow effectively.