Everyone knows home loans in Port Kennedy WA are key to making your dream home a reality.

But what exactly does a home loan broker do for you?

Here’s your complete cheatsheet for working with a home loan broker in Port Kennedy WA.

Some are experts at simplifying complex finance jargon.

Some are local market insiders who understand Rockingham and Perth properties.

Some are skilled at tailoring refinancing and investment loans.

Some help first-home buyers unlock grants and government schemes.

Some make the loan application process fast and stress-free.

Let’s dive right in.

Why Use a Home Loan Broker in Port Kennedy WA?

If you’re ready to buy, refinance, or invest in Port Kennedy, a home loan broker can be your best ally. They connect you to lenders’ suites of products tailored for WA locals. And they understand unique market conditions around Rockingham and Perth.

According to local market insights, Port Kennedy sits within a tightly sold area within the broader Rockingham and Perth region. Property prices are rising steadily. That means getting the right loan can dramatically affect your monthly payments and long-term wealth growth.

A home loan broker port kennedy wa will guide you through this complex landscape. They deliver options you might not find online and handle all the paperwork, so you can focus on your property goals.

How Does a Home Loan Broker in Port Kennedy WA Help You?

Their main jobs include:

- Loan product comparison — evaluating interest rates, features, and fees across lenders

- Access to local lenders and special deals not widely advertised

- Expert advice on first home buyer grants, refinance options, or investment lending

- Handling your loan application and documentation for smooth approvals

- Refinancing strategies to help you reduce your payments or free up equity

Take refinancing in Port Kennedy for example: rising property values coupled with low interest rates present a great opportunity. A broker can show you how to use your property equity wisely without stress (source).

What Should You Look for in a Home Loan Broker Port Kennedy WA?

Choose a broker with:

- Local knowledge of Port Kennedy, Rockingham, and Perth markets

- Strong lender networks including WA-based and national lenders

- Experience with first home buyers, investors, and refinancing

- Clear communication and personalised service

- Transparent fees and no hidden costs

At The Mortgage Suite, we pride ourselves on providing exactly this level of service for Port Kennedy clients. You can also explore our resources like our complete guide to choosing a Perth home loan broker to understand what questions to ask.

How to Prepare for Your First Meeting with a Home Loan Broker

Come ready with:

- Your income details (pay slips, tax returns)

- Information on existing debts

- Your savings and assets

- Details about the property you want to buy or refinance

- Questions about grants, loan types, and interest rates

Being organised will help your broker present the best options quickly.

Quick Tip: Ask about lending products available for first home buyers in Port Kennedy, such as government grants and Keystart loans. These options can substantially reduce the upfront costs (source).

What Loan Options Are Available in Port Kennedy WA?

Whether you’re a first home buyer, a property investor, or looking to refinance your existing mortgage, brokers in Port Kennedy WA offer access to a range of loans:

- First Home Buyer Loans: With modest deposits and tailored grants.

- Investment Loans: Loans designed for rental properties and portfolio growth.

- Refinancing Loans: To reduce interest rates or extract equity.

- Construction Loans: For building your dream home with staged drawdowns.

- Debt Consolidation Loans: To combine debts into manageable repayments.

This flexibility ensures your loan fits your unique situation, even when traditional banks might say no. Many brokers in Port Kennedy can help you navigate options like low deposit loans and government schemes efficiently (internal link).

What Are the Current Property Market Trends Affecting Home Loans in Port Kennedy?

Port Kennedy is part of the Rockingham area, which, together with Perth, has experienced dynamic market changes in recent years.

Recent data shows median house prices in Perth are rising steadily, currently sitting above $515,000, with a tight rental market pushing rents upwards (source).

What does this mean for you? Simply put, it’s a seller’s market and a challenging buying environment, but also an opportunity to leverage equity and secure low-interest loans before rates rise.

Did you know: The local rental vacancy rate has dropped to near historic lows, signalling increased demand and potential for property investors to benefit from strong rental yields.

Interest rates have remained low in WA, but caution is advised as the current economic forecast suggests rates may adjust within the next couple of years. This makes now a prime time to lock in favourable lending terms with a trusted home loan broker.

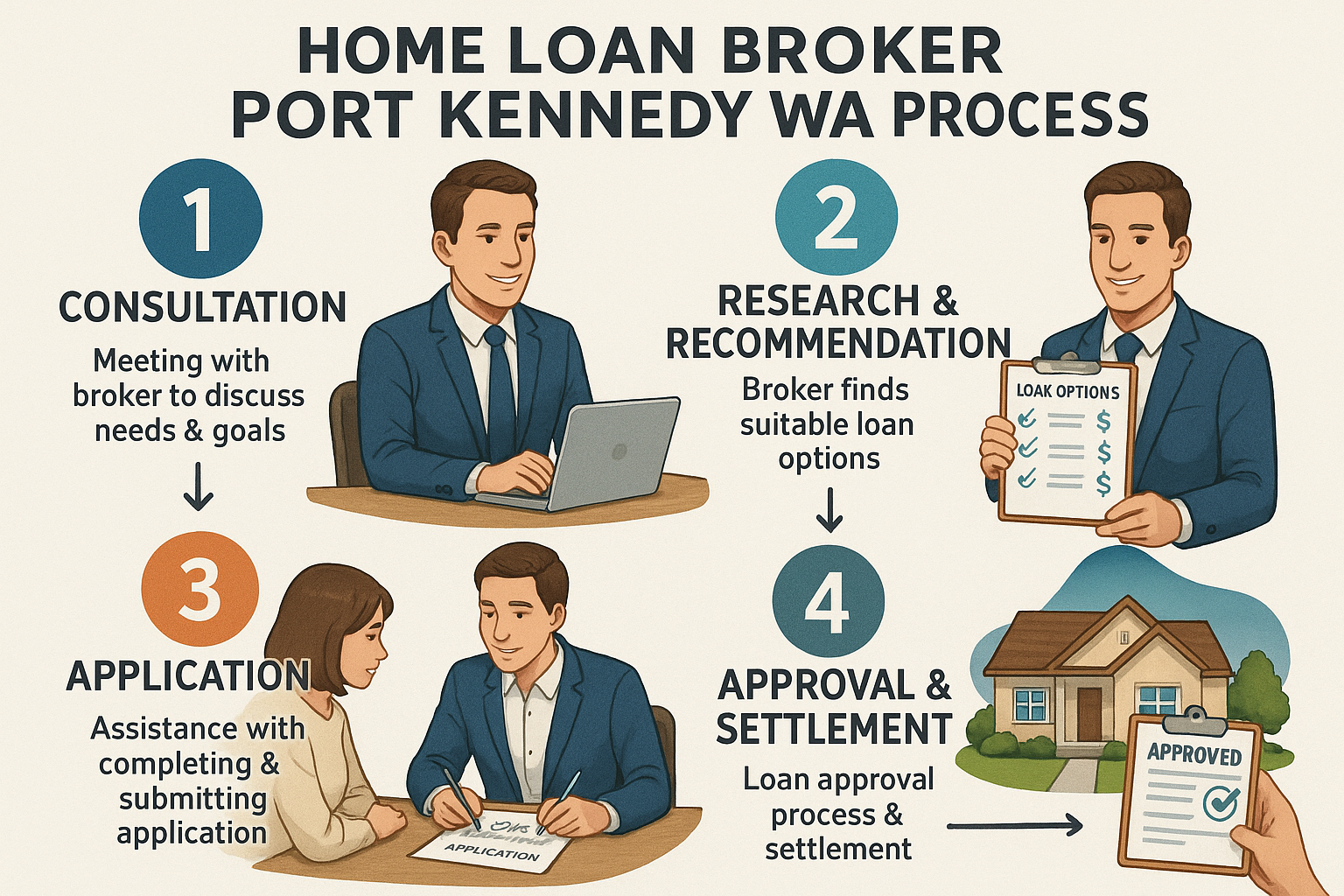

How Does the Lending Process Work with a Mortgage Broker in Port Kennedy?

The journey usually follows these steps:

- Initial Consultation: You discuss your property goals, finances, and timeline.

- Loan Assessment: The broker analyses your situation and compares lenders.

- Loan Application: Your broker submits applications on your behalf, managing document requests.

- Loan Approval and Offer: Once approved, your broker helps you review and accept the best offer.

- Settlement and Support: They coordinate with solicitors and lenders until settlement is complete.

The expert navigation by a mortgage broker speeds up processing, reduces stress, and maximises your chances of approval.

What Should You Ask Your Home Loan Broker?

Here’s a shortlist:

- What are the total costs and fees involved?

- Which loan products suit my financial situation?

- Are there any government grants or stamp duty concessions I qualify for?

- What happens if interest rates rise?

- Can you explain the loan repayment options and terms?

- How long will approval and settlement take?

Asking the right questions saves headaches and ensures you select the right loan.

How Can Investors Benefit From Home Loan Brokers in Port Kennedy WA?

Investment loans come with their own complexities. Local brokers understand:

- How to structure loans for rental income and debt coverage ratio requirements

- Options for scaling property portfolios, including conventional and non-conventional loans such as DSCR loans

- Risk management tactics and refinancing opportunities to maximise cash flow

Many investors find that a broker’s advice and access to lower down payment loans, tailored advice on property finance, and smart refinancing can help them grow their portfolio and protect their investment over time (internal link).

What Are Common Mistakes to Avoid When Working With Home Loan Brokers?

1. Not doing your homework. Don’t meet a broker without knowing your own financial picture.

2. Assuming one broker is the only option. Shop around. Different brokers have access to different lenders and products.

3. Ignoring loan terms. Look beyond interest rates—fees, penalties, insurance, and flexibility matter.

4. Rushing decisions. Buying or refinancing is a major financial commitment. Take your time to understand every detail.

5. Missing out on government grants or local schemes. A good broker helps you navigate these but being informed yourself is smart.

How to Choose the Right Home Loan Broker in Port Kennedy WA

Look for:

- Local expertise: Someone familiar with Port Kennedy’s property market and lenders.

- Professional credentials: Membership of credible industry groups and clear fee disclosures.

- Positive reviews and testimonials from clients in Rockingham and Perth.

- Transparent communication and a willingness to explain in simple terms.

- Responsiveness and availability to support your journey.

You can start your search by reviewing quality local brokers through resources such as our guide on working with a mortgage broker in Port Kennedy.

How Much Does a Home Loan Broker Charge in Port Kennedy WA?

Most brokers work on commissions paid by lenders, so their service is free to you. However, some may charge a fee if they perform extra services.

Always ask upfront about costs. Reputable brokers will be transparent.

Remember, the peace of mind, tailored advice, and time saved usually more than outweigh broker fees.

Can a Home Loan Broker Help with Refinancing in Port Kennedy WA?

Absolutely! Refinancing is one of the most valuable services brokers provide.

They’ll assess if switching loans or pulling equity is right for you. With rising property values locally and continued low interest rates, many homeowners in Port Kennedy could benefit from refinancing.

Whether it’s debt consolidation, lower repayments, or upgrading your home loan, a broker will navigate the details and negotiate with lenders for you.

Learn more about refinancing strategies in our detailed Perth mortgage refinance guide.

How Do Government Home Loan Schemes Impact Buyers in Port Kennedy WA?

First home buyers in WA can access several grants and concessions like the First Home Owner Grant (FHOG) and Keystart loans.

Brokers in Port Kennedy know how to help you meet eligibility criteria and apply correctly.

These programs can reduce upfront costs significantly and make owning your first home more affordable.

To understand the latest government schemes and how they apply, check out this analysis of WA government home loan schemes.

Expert Tip: How Does Your Credit Score Impact Home Loan Options?

Your credit score shapes what loans you qualify for and the interest rates offered.

A broker will review your credit file proactively and guide you to boost it if needed.

Sometimes, working with a broker can even help secure loans with slightly less-than-perfect credit by leveraging their array of lender contacts.

Maintaining healthy financial habits, like reducing debt and paying bills on time, always helps secure the best rate.

How Can You Scale Your Property Portfolio with a Home Loan Broker Port Kennedy WA?

Ready to grow your investments? Brokers understand complex loans like DSCR (Debt Service Coverage Ratio) loans and business bank statement loans that assist investors to finance multiple properties without being limited by conventional debt-to-income rules (internal link).

They can identify loan structures that maximise your buying power while managing risk.

Having a finance plan with your broker means you’re prepared to jump on investment opportunities when the market changes.

What to Expect from the Loan Approval Process?

After submitting your application, lenders verify your financial documents and assess your borrowing capacity.

This process might include credit checks, property valuations, and confirming incomes or rental forecasts for investment properties.

Your broker shepherds you through these stages, answering lender queries swiftly so your approval proceeds efficiently.

A typical approval timeline can range from days to weeks depending on the complexity of your loan.

How Can You Prepare for Settlement and Finalise Your Home Loan?

Once approved, work with your conveyancer or solicitor alongside your broker to meet all settlement milestones.

This includes signing the loan contract, arranging insurance, and transferring funds.

Your broker will keep communication clear and timed well with the lender to ensure a smooth handover.

Common Questions About Home Loan Brokers in Port Kennedy WA

What’s the difference between a home loan broker and a bank?

A broker compares multiple lenders and loan products, offering impartial options. Banks usually only offer their own products.

Will a mortgage broker cost me extra?

Usually not. Most are paid commissions by lenders. Always ask upfront if fees apply.

How long does getting a loan through a broker take?

It depends, but brokers can often speed up the process by managing paperwork and follow-ups.

Can a broker help if my credit isn’t perfect?

Yes. Brokers know lenders who accept various credit situations and can advise on improving your score.

Are brokers regulated?

Yes, mortgage brokers in WA are licensed and must follow strict compliance and consumer protection laws.

How to Start Working with a Home Loan Broker in Port Kennedy

Find brokers with strong local presence and client reviews through trusted sites or referrals.

Book a free initial consultation to explore your options and ask questions.

Prepare your financial documentation beforehand to make the process efficient.

Remember, working with a trusted professional locally gives you a clear advantage in today’s competitive property market.

Navigating Local and Perth Property Markets With Your Home Loan Broker

Port Kennedy’s proximity to Rockingham and Perth means it benefits from shifting dynamics across these real estate markets.

Understanding where the demand hotspots are, what grants apply locally, and timing your finance matters.

Consulting brokers experienced in all three areas helps you tap into the right resources and loans suited for your property ambitions.

Discover more about local market trends and financing in Rockingham and check how they relate to Perth’s broader property finance landscape (internal link).

Frequently Asked Questions About Home Loan Broker Port Kennedy WA

How much can a home loan broker save me in Port Kennedy?

Brokers can save you thousands by negotiating rates, cutting fees, and helping you claim grants and schemes.

Can a broker help with low deposit loans?

Yes, they know lenders and programs allowing deposits as low as 2%, ideal for first home buyers (internal link).

What documents do I need to apply through a broker?

Generally proof of income, ID, savings details, and information on existing debts.

Does a home loan broker charge fees for consultation?

Most offer free initial consultations but clarify fees before proceeding further.

Is it better to go direct to lenders than a broker?

Not usually. Brokers provide options, save time, and often get better deals.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your home loan journey in Port Kennedy WA? For personalised advice, contact us!

(Verified with sources as of 2025-09-06)

Sources: Rockingham local market insights, Perth refinance guide, WA government loan schemes, Investment home loans Perth.

For more detailed tips on home loans in WA, check out Mortgage Choice Secret Harbour and explore the broader benefits of working with trusted brokers.