TL;DR: A home loan broker in Baldivis empowers you to unlock the best home financing options, helping with loans, grants, and tailored advice. Here’s a comprehensive guide to make your property journey smoother.

A home loan broker Baldivis is a well-known expert who can streamline the complexities of property financing for locals.

But what exactly does a home loan broker Baldivis do for you?

This article provides a complete cheatsheet to understanding and choosing the right home loan broker in Baldivis.

Some are specialists in first home buyer loans who know the local WA grants inside out.

Some are experienced with refinancing to help you save on your mortgage repayments.

Some focus on investment home loans tailored for the Baldivis property market.

Some make navigating construction and bridging loans painless with step-by-step guidance.

Some combine local market insight with personalised lending advice for every client.

Let’s dive right in.

What Does a Home Loan Broker Baldivis Actually Do?

At its core, a home loan broker Baldivis acts as your trusted adviser. They work as the middleman between you and the banks or lenders, which means less legwork but more access to tailored home loan options. Unlike direct bank applications, brokers have relationships with over 60 lenders, allowing them to custom-fit loan structures that suit your financial situation and goals.

For example, they:

- Assess your borrowing capacity with accurate calculations.

- Identify your eligibility for government grants like the first Home Owner Grant and stamp duty concessions.

- Simplify the jargon and paperwork.

- Handle the loan application process to fast-track approvals.

- Offer expert advice on refinancing or investment loans.

- Follow up post-settlement to ensure your loan still works for you.

Think of them as your personal home finance specialist in Baldivis, navigating the local lending landscape for you. The Mortgage Suite’s Baldivis Brokers highlight the value of tailored advice that considers your unique circumstances beyond just interest rates.

Why Should I Use a Home Loan Broker in Baldivis?

Many first-time buyers and seasoned investors ask: “Why can’t I just apply for a home loan myself?” The answer lies in expertise and access.

Are you confident in navigating lending policies and ever-changing grant eligibility alone?

A qualified home loan broker Baldivis saves you time by cutting through financial jargon, uncovering loan products that you might not find online, and negotiating on your behalf.

Plus, brokers often identify grants and state-specific benefits relevant to Baldivis residents, such as stamp duty waivers or the First Home Owner Grant. This guidance can save thousands on your purchase.

Lastly, a broker will help you avoid costly pitfalls, like loans that look attractive but carry hidden fees or unsuitable features for your plans.

How Do I Choose the Right Home Loan Broker in Baldivis?

Not all loan experts are created equal. Here’s a detailed checklist to find a home loan broker that fits you:

- Local expertise: Choose a broker who understands Baldivis property trends and local lending nuances.

- Track record: Look for brokers with solid reviews and success stories.

- Transparency: A trustworthy broker discloses how they’re paid and works in your best interests.

- Range of lenders: Brokers connected to numerous banks have more options, which can mean better rates.

- Communication: Ensure they explain everything clearly and are accessible.

- Support: Post-loan settlement support is golden—does the broker keep in touch?

For a deep dive on choosing expertly, check Finding the Right Mortgage Broker in Western Australia.

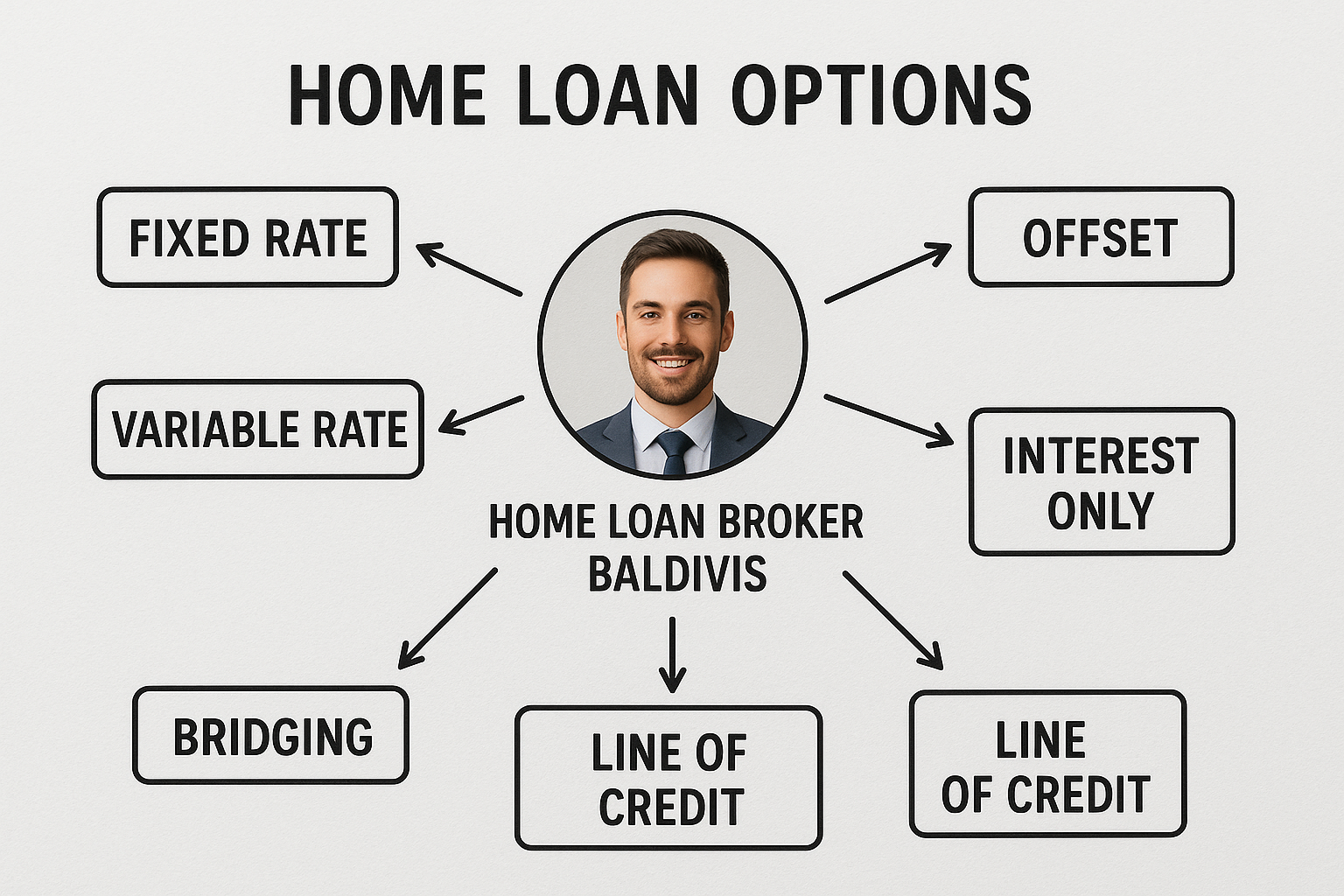

What Types of Loans Can a Home Loan Broker Baldivis Help With?

Whether you’re a first home buyer or a property investor, a broker can guide you through many loan products.

- First Home Buyer Loans: Helping you access grants, low deposit options, and tailored advice for your first property (First Home Buyer Loans in Baldivis).

- Refinancing: Reassessing your existing loan to seek better rates or restructure your repayments can save you money long-term.

- Investment Home Loans: For growing your property portfolio, brokers help structure loans with strategic tax and finance planning (Investment Home Loans Perth).

- Construction Loans: Managing the financing stages of building your dream home, including draws and inspections (Construction Loans Baldivis).

- Debt Consolidation Loans: Simplify loan repayments and reduce interest by consolidating multiple debts.

Every loan type carries its specific documents, eligibility rules, and conditions. Your broker ensures you’re prepped and supported at every step.

How Can a Home Loan Broker Help With First Home Buyers Grants?

Many buyers underestimate the impact of available grants and concessions. For example, the First Home Owner Grant in Western Australia can potentially save you $10,000 or more off your property purchase.

A home loan broker keeps track of changes in government policies and eligibility criteria to ensure you don’t miss out. They can help you gather necessary documentation and lodge applications correctly.

This expertise puts you a step ahead, especially in a competitive Baldivis market where timing and preparedness matter.

What Are Common Mistakes to Avoid When Using a Home Loan Broker?

Knowing pitfalls to watch out for keeps your home loan process smooth. Here are key mistakes to sidestep:

- Not verifying the broker’s credentials or reputation.

- Failing to disclose your complete financial situation honestly and upfront, which can delay or derail applications.

- Choosing brokers based solely on advertised interest rates without considering loan features or fees.

- Ignoring the importance of ongoing loan review post-settlement for better refinancing opportunities.

- Not comparing broker services and lender panels to ensure a competitive edge.

Stay proactive and engaged throughout to make the best decisions.

How Do I Prepare to Meet With a Home Loan Broker Baldivis?

Preparation helps you get the most out of your consultation. Here are essentials to bring:

- Proof of income and employment history (payslips, tax returns).

- Bank statements and existing loan statements.

- Details of your expenses and debts, including credit cards or personal loans.

- Identification documents like driver’s license or passport.

- Information about the property you intend to buy, or general budget plans.

Being transparent about your finances enables your broker to tailor the best loan options faster and place the application with the most suitable lender for success.

Quick tip: If you’re self-employed, bring your most recent business financials — this helps clarify borrowing power.

How Does the Application Process With a Home Loan Broker Work?

After understanding your situation, your broker will:

- Research and shortlist loan products from various lenders suitable to you.

- Explain options clearly, including benefits and drawbacks.

- Help submit your loan application with complete documentation.

- Coordinate any additional information requests from lenders.

- Negotiate on your behalf for better terms when possible.

- Stay in touch until settlement, then continue helping you manage or refinance.

They take the hassle off your hands and make the process far less daunting.

Can a Home Loan Broker Help With Refinancing in Baldivis?

Yes! Refinancing can lower your interest rates, reduce repayments, or adjust your loan term.

But refinancing is tricky—you need to consider break fees, current rates, and your long-term plans.

A home loan broker Baldivis assesses whether refinancing makes sense for you, compares thousands of loan options, and manage all paperwork.

This saves you hours of research and could save thousands of dollars over your loan’s life.

For details on refinancing strategies in WA, explore Navigating Mortgage Refinance in Perth.

How Does Local Knowledge of Baldivis Brokers Benefit Me?

Property markets differ significantly, even within the Perth metropolitan area.

A Baldivis home loan broker understands:

- Local market trends and property values.

- Suburb-specific lender preferences.

- Upcoming developments influencing property prices.

- Tailored loan products suited for Baldivis residents.

- Local government grants and concessions.

This inside knowledge empowers you to secure loans that match your financial goals and property plans closely.

Furthermore, their relationships with local lenders often enable quicker approvals and better rates.

FAQ About Home Loan Broker Baldivis

- How much does it cost to use a home loan broker Baldivis?

- Usually, home loan brokers are paid by the lender, so their service is at no extra cost to you. Always confirm any fees upfront.

- Can a broker help if I’m self-employed?

- Absolutely. Experienced brokers understand the documentation self-employed clients need and can navigate lender criteria accordingly.

- What if my credit score isn’t perfect?

- A good broker identifies lenders that consider your full financial profile and advises you on improving credit before applying.

- How long does it take to get a loan approved?

- Processing times vary but brokers can expedite steps during application and documentation to speed approvals.

- Are brokers allowed to recommend specific lenders?

- Yes, but they must consider your best interests and disclose their relationships. Transparency ensures you’re well-informed.

What Next Steps Should I Take Working With a Home Loan Broker Baldivis?

Start by gathering your financial documents and booking a consultation with a trusted Baldivis broker like the mortgage suite – contact us!

Ask plenty of questions, request clear explanations, and seek personalised loan options—not just the lowest headline rate.

Remember: a knowledgeable broker will be your partner from house hunting to final settlement and beyond.

What’s Your Next Step?

For personalised advice, contact us!

As you consider your home loan options, don’t miss exploring detailed advice in Home Loan Broker Perth: Your Comprehensive Guide. It reveals strategies to secure loans throughout the Perth region.

For guidance about low deposit options tailored to today’s market, check out our Low Deposit Home Loans Perth guide.

And if you are curious about refinancing in the Rockingham area, discover more about mortgage brokers Rockingham and their local insights.

If your taxes arent up to date, this is a great place to start. A recommended tax accountant https://perthbusinessaccountant.com.au/

(Verified with sources as of 2025-09-05)