TL;DR: Construction home loans in WA require careful planning, larger deposits, and staged funding to turn your dream home into reality. Here’s a full breakdown of timelines, documentation, and tips to make the process smooth.

Construction home loans WA are a popular financing option for many aspiring homeowners in Western Australia looking to build rather than buy off the plan or existing properties.

But what exactly are construction home loans, and how do they work?

Here’s a complete cheatsheet covering everything you need to know –

Some are short-term loans with staged drawdowns linked to your builder’s progress.

Some require a larger deposit than standard home loans – around 20-25% of the project value.

Some involve multiple financing stages – from land purchase, construction funding, to the permanent mortgage.

Some come with interest-only repayments during the build to ease cash flow.

Some demand detailed documentation upfront – like builder contracts, plans, and budgets.

Let’s dive right in.

What Is a Construction Home Loan in WA?

A construction home loan in WA is a specialized mortgage designed to finance the building of a new home. Unlike traditional home loans, which cover the purchase of an existing property, construction loans provide funds in stages as your house progresses from design to completion.

The loan amount typically covers land purchase (if not already owned), building materials, labour costs, and other construction-related expenses.

This type of loan is more complex due to phased funding and higher lender risk, resulting in different requirements and repayment structures compared to standard mortgages.

Why Choose a Construction Home Loan?

Building allows you to customise your home from the ground up, incorporating modern designs and energy efficiencies. It’s often the preferred option for people wanting more control over their property and taking advantage of new developments like those in Baldivis.

How Do Construction Loans Work in WA?

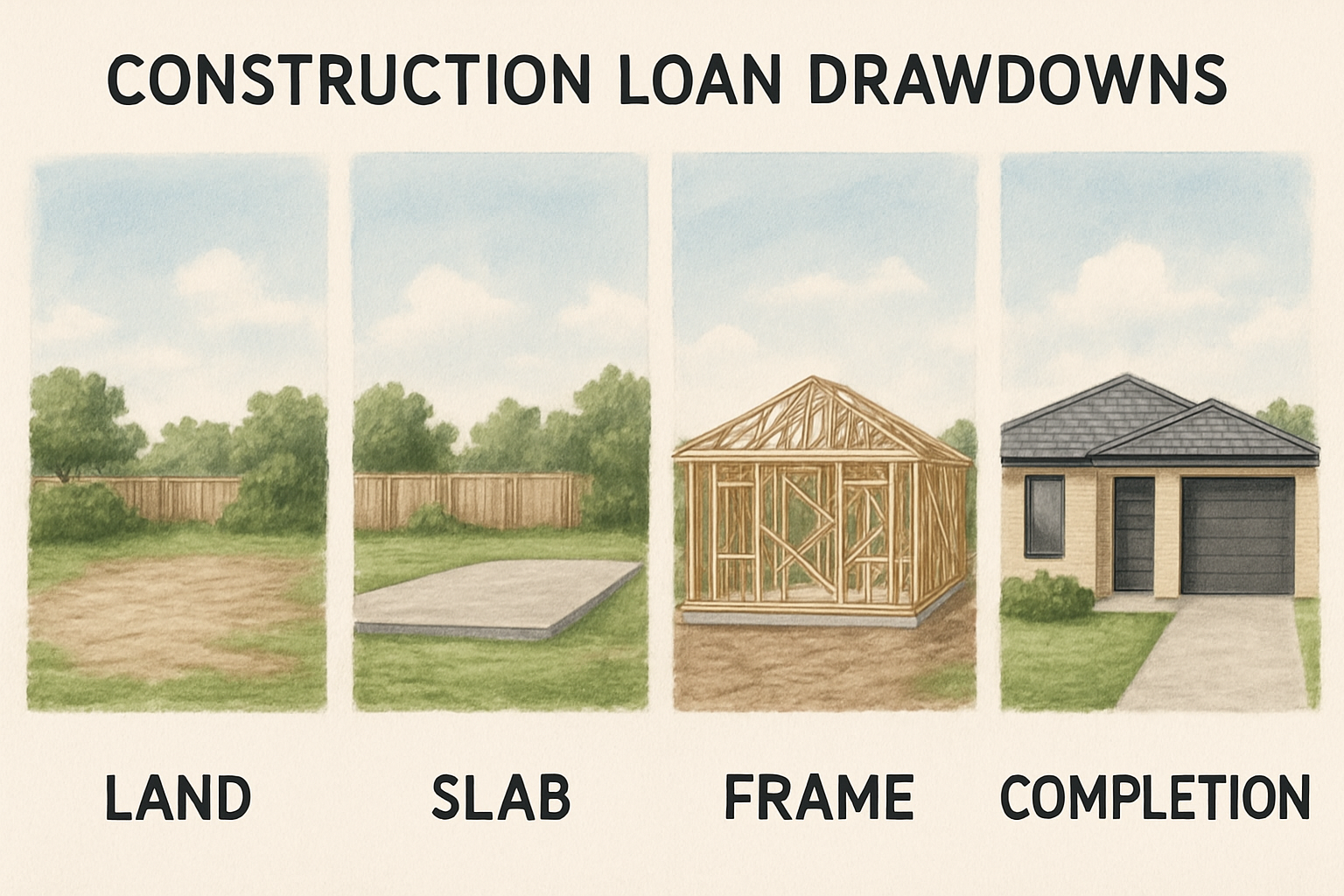

Construction home loans in WA work differently from traditional loans because funds are paid out in draws aligned with construction milestones.

- Stage 1: Settlement of land – before building starts.

- Stage 2: Builder approval and finalising detailed building plans with cost estimates.

- Stage 3: Loan approval and documentation submission, including contracts and builder registrations.

- Stage 4: Drawdown phases – lenders release funds incrementally as parts of construction are completed and verified.

- Stage 5: Transition to a standard home loan or mortgage once construction is completed.

You usually pay interest only on funds drawn during construction, which can ease monthly costs while building.

It’s important to understand this timeline to plan your budget and avoid surprises.

Typical Timeline Breakdown

Building a home with a construction loan can take anywhere from 10 to 18 months from land purchase to move-in.

- Land acquisition: 1-2 months, including securing title and approvals.

- Design and approvals: 3-4 months planning, council approvals, and contractor selection.

- Construction phase: 6-12 months for slab, brickwork, roof cover, lockup, and practical completion.

- Final inspections: After practical completion.

Keep in mind, unexpected delays happen (e.g., weather, supply chain issues) that can extend timelines.

What Documentation Is Needed for Construction Home Loans WA?

Before approval, lenders expect a robust set of documentation to assess risk and project viability. Here’s what you’ll typically need:

- Proof of income: Payslips, tax returns, or business financials.

- Credit history: Detailed credit reports demonstrating financial reliability.

- Land details: Title deeds or contracts if the land is already owned or to be purchased.

- Builder’s contract: Signed agreement with a registered builder including scope and payment schedule.

- Construction plans: Detailed architectural drawings, specifications, and permits.

- Cost estimates or budget: Comprehensive construction budget with contingencies.

- Progress reports: For loans already underway, you may need to submit inspection certificates and progress photos.

Gathering these documents early can speed up the application and avoid delays.

What Are the Key Lender Requirements for Construction Home Loans in WA?

Lenders in Western Australia look carefully at the following before approving construction loans:

- Deposit size: As low as 2% of the total land and build cost.

- Builder credentials: Registered, reputable builders with verifiable track records are mandatory.

- Clear project plans: Detailed floor plans, contracts, and budgets are needed.

- Financial stability: Solid income and credit rating demonstrating repayment ability.

- Contingency funds: Lenders expect borrowers to have reserves to cover unforeseen expenses during construction.

Being prepared for these requirements can improve your chances of approval, so having expert guidance from a lending adviser or mortgage broker in WA is invaluable.

How Are Construction Loan Funds Drawn? What Are Draw Schedules?

Funds in a construction loan are released progressively in stages, often called draws. Common draw milestones include:

- Completion of footings and foundation

- Frame erected

- Lockup stage (roof, windows, external walls finished)

- Fixing stage (plasterboard, wiring, plumbing)

- Practical completion (ready for habitation)

After each stage, inspections confirm work is done satisfactorily before releasing the next draw. This process ensures your money is used correctly and protects lender and borrower alike.

Tip: Align payment expectations carefully with your builder to avoid cash flow issues and ensure smooth construction progress.

What Are Common Types of Construction Loans Available in WA?

Understanding the types of construction loans can help you choose the right fit:

- One-time close (construction-to-permanent loans): Combines construction financing and permanent mortgage in one loan, reducing paperwork and cost but can be harder to qualify for.

- Two-time close loans: Separate loans for construction and permanent financing; provides flexibility but requires two approvals and two closings.

- Construction-only loans: Fund only the building phase; borrower must secure separate mortgage after build completion.

Government-backed loans such as those using FHA, VA, or conventional programs may offer one-time close construction loans to eligible borrowers.

How to Prepare Your Payment Plan During Construction?

Since construction loans usually have interest-only repayments during the build, you should factor these costs into your budget. Often, interest payments accrue only on drawn amounts, not the loan limit, which helps reduce initial payment burdens.

However, you may continue to pay rent or mortgage on your current home during construction. Planning for this overlap is crucial to avoid financial strain.

Unexpected expenses often arise with building projects. Most experienced builders recommend setting aside at least 10% contingency funds beyond the quoted budget to cover surprises.

Carefully coordinate the draw schedule with your builder to ensure timely payments and avoid delays.

How Can a Local Mortgage Broker Help with Construction Home Loans WA?

Mortgage brokers specialising in WA property finance bring invaluable local expertise. They can:

- Help you sort through lender options tailored for construction loans.

- Provide guidance on local builder approvals and regulations.

- Streamline your application process by preparing the correct documentation.

- Advise on the best loan structure according to your financial situation.

- Assist in managing timelines and critical milestones to keep the build on track.

For those building a home in areas like Baldivis, Rockingham, Port Kennedy, or Wellard, expert local home loan brokers offer personalised service to maximise your chances of a smooth loan journey. Learn more from Mortgage Broker Baldivis and Mortgage Broker Rockingham.

What Are the Benefits and Challenges of Using Construction Loans in WA?

Benefits:

- Customise your home design to suit your lifestyle and needs.

- New builds tend to be more energy-efficient, lowering future utility bills.

- Modern appliances and finishes reduce maintenance costs.

- Potential to build equity and increase property value as the home is completed.

- Access to government grants and incentives for new builds where eligible.

Challenges:

- Larger deposits required compared to traditional home loans.

- Complex application with more stringent credit and documentation requirements.

- Phased funding means managing multiple payments and approvals.

- Possible overlap in housing costs if you rent or have an existing mortgage.

- Unforeseen construction delays or cost overruns require contingency funds and strong communication with your builder and lender.

Careful planning and expert support can help overcome these challenges.

Where Are Some Recommended Areas in WA for Building New Homes?

Popular growth corridors such as Baldivis and Rockingham in Western Australia offer attractive house and land packages. Developments like Spires Estate in Baldivis come with community design guidelines ensuring neighbourhood harmony and offer incentives to new homebuyers.

Baldivis especially combines affordability with access to amenities — close shopping, schools, and easy freeway access to Perth CBD.

How Can You Plan for Unexpected Costs and Delays When Building?

Construction projects can face unanticipated challenges. From supply chain issues to weather interruptions, delays can affect your budget and timeline significantly.

Experts recommend setting aside a contingency fund of at least 10-15% of your budget to cover unexpected costs. Transparent, ongoing communication with your builder and timely draw approvals are critical.

Track your build progress closely, request detailed invoices, and review contracts for penalty clauses or cost escalations.

Having a contingency strategy helps you stay financially stable and avoid payment disruptions that could stall construction.

What Tips Can Help You Succeed with Construction Home Loans in WA?

- Start Early with Documentation: Collect all necessary documents—income proof, builder contracts, plans—before applying to shorten turnaround times.

- Choose Licensed Builders: Verify builder registrations and reviews to minimise risk.

- Use Local Experts: Work with mortgage brokers who understand WA lenders and local building regulations.

- Save for Higher Deposits: Expect to put down 20-25% or more upfront, including land equity if owned.

- Plan for Overlap Costs: Account for paying on your current home while your new one is under construction.

- Communicate Clearly: Align your loan draw schedules with builder milestones to avoid hold-ups.

- Consult Online Resources: Check development guides such as Spires Baldivis home buyer info to understand local covenants and incentive programs.

Can You Use Government Grants with Construction Loans WA?

Yes! First home buyer grants and other government incentives often extend to new builds, including construction loans.

For example, the First Home Owner Grant (FHOG) in WA sometimes supports buyers building new homes under qualifying conditions. Always confirm eligibility criteria and grant application deadlines to maximise your benefits.

For insights into these programs, visit our guide on first home buyer grants in WA.

Why Is Local Knowledge Important for Construction Loans in WA?

The property market and lender criteria can vary significantly across WA suburbs. Working with mortgage or home loan brokers in specific areas like Rockingham or Wellard gives you a distinct advantage when navigating regional building regulations, community guidelines, and local lender preferences.

Local experts understand ongoing developments like community design covenants (e.g., in Spires Baldivis) and can help tailor your loan package accordingly.

Frequently Asked Questions About Construction Home Loans WA

Q: How much deposit do I need for a construction home loan in WA?

A: Anywhere from 2% of the combined land and building cost. If you already own the land, its value can often count towards your deposit.

Q: Can I get a construction loan if I don’t own the land?

A: Yes, but you’ll need to secure a land loan first or combine land purchase with your construction loan, depending on the lender.

Q: What documentation must I provide for loan approval?

Income proof, credit history, builder contracts, detailed plans, and cost estimates are essential. Submission quality can affect approval speed.

Q: How long does a construction home loan process take?

Usually 1-2 weeks for approval, plus 10-18 months for building completion depending on your project scope and builder.

Navigating Challenges: What If Construction Costs Exceed Budget?

It’s a common scenario for budgets to increase during builds due to unforeseen challenges. What should you do?

First, keep a contingency fund ready. Communicate early with your builder and lender about potential cost overruns.

Sometimes lenders will consider a loan variation for increased amounts if justified by professional quotes and valuations.

Failing this, you may need to fund extras from personal savings or adjust your building scope.

Financial planning and expert advice upfront reduce the risk of unpleasant surprises.

What Are the Best Strategies for Securing Construction Home Loans WA?

Experts suggest the following to improve your loan prospects:

- Maintain a strong credit history and stable income profile.

- Save deposit plus additional buffer.

- Choose a reliable, registered builder and supply comprehensive documentation.

- Pre-approve loans before signing contracts to avoid timing issues.

- Engage mortgage brokers with a WA focus who can negotiate lender criteria and rates.

These strategies support a smoother process and better terms.

How Do I Choose the Right Mortgage Broker for My Construction Loan WA?

Look for brokers who:

- Focus on Western Australia property finance, especially construction loans.

- Have proven experience working with local builders and lenders.

- Offer clear explanations and transparent fees.

- Have positive client reviews and professional accreditations.

To start, consider reading our guide on Finding the Right Mortgage Broker in Western Australia.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your construction home loans WA journey? For personalised advice, contact us!

For more detailed local tips on home loans and mortgages, check out our article on Home Loan Broker Perth to understand WA policies and lender requirements.

Also, consider exploring insights on managing your overall home financing strategy with our guide on investment home loans in Perth.

Building your dream home in WA takes preparation, but with the right knowledge and expert support, construction home loans can be a smooth path to homeownership. (Verified with sources as of 2025-08-30)