Unlocking the Potential of Investment Home Loans in Perth

Investment home loans in Perth remain a cornerstone for property investors looking to build wealth.

But what exactly do they entail, and how can you make the most of them?

This comprehensive cheatsheet breaks down everything you need to know about investment home loans Perth.

Some are tailored for first-time property investors keen on leveraging the local market.

Some are structured to maximise cash flow and tax benefits efficiently.

Some come with strict lending criteria and higher entry costs.

Some offer refinance options to help optimise your loan over time.

Some allow for pre-approval, setting you up for success before you start house-hunting.

Let’s dive right in.

What Are Investment Home Loans?

Investment home loans are specifically designed to finance properties purchased primarily for rental income or capital growth, rather than owner occupancy. Unlike standard home loans, these loans typically require higher deposits (usually 20-25%) and have stricter lending criteria.

In Perth, these loans cater to property investors who want to capitalise on the region’s dynamic property market. The loan interest and many associated costs are often tax deductible, making them a strategic tool for building wealth.

One significant distinction is that lenders often assess investment loans by placing more emphasis on the rental income potential of the property itself and less on the borrower’s income compared to owner-occupier loans. This can benefit investors who have other income streams or assets but limited personal income documentation.

However, interest rates on investment home loans are generally higher by around 0.5% to 0.75% compared to owner-occupied loans, reflecting the increased risk lenders perceive.

The minimum credit score expected is often a little higher too — typically around 620 to 660 — depending on the lender.

Key Pros and Cons of Investment Home Loans in Perth

Pros

- Potential Tax Deductions: Interest payments and certain costs like property management and maintenance are typically tax-deductible, helping improve net returns.

- Leverage for Portfolio Growth: Allows building multiple properties, creating diversified income streams and capital growth opportunities.

- Structured Loan Features: You can often set up split loans, offset accounts, and redraw facilities aligned with investment goals.

- Refinancing Options: Tailored to allow tapping into equity or restructuring loans to optimise payments or terms over time.

Cons

- Higher Deposit Requirements: Usually 20-25%, which means the upfront cost is significantly more than for owner-occupied loans.

- Increased Interest Rates: Investors pay a premium on interest rates, raising ongoing costs.

- Stricter Approval Criteria: Lenders may require more comprehensive documentation including rental appraisal and stronger credit history.

- Rental Vacancy Risks: Periods without tenants can impact your ability to meet repayments.

- Ongoing Management Responsibility: Managing tenants, maintenance, and compliance can be time-consuming unless outsourced.

Understanding these elements helps you balance the financial benefits with the responsibilities investment properties bring.

How to Choose Investment Home Loans in Perth

Choosing the right investment home loan requires carefully assessing your financial situation, investment goals, and risk appetite. Here’s a practical approach:

- Determine Your Borrowing Capacity: Engage a mortgage specialist or a home loan broker in Perth to understand how much you can borrow based on your income, savings, and existing commitments.

- Check Loan Features: Consider whether you’ll need interest-only periods (common in investment loans), fixed or variable rates, and the flexibility of redraw or offset accounts.

- Compare Interest Rates and Fees: Look beyond headline rates to total loan costs including ongoing fees and potential exit penalties.

- Consider Tax Implications: Consult an accountant to understand the full tax benefits and obligations, ensuring your loan structure aligns with your investment strategy.

- Prepare for Rental Income Assessment: Provide robust rental appraisals from trusted agents or use market data to support your application.

- Factor in Refinancing Potential: A good loan will give you options to refinance as market conditions change.

Selecting a loan is not a one-size-fits-all process. Tailored advice often saves time, money, and stress in the long run.

Estimating Costs and Deposits: What to Expect

When applying for investment home loans in Perth, you should expect to put down a higher deposit, typically in the range of 20-25% of the purchase price. For example, if you’re looking to buy an investment property worth $450,000, your deposit may be approximately $90,000, plus additional upfront costs.

These costs include:

- Stamp Duty: Though WA offers some concessions, investors generally pay full stamp duty, which can add tens of thousands depending on the purchase price.

- Lender’s Mortgage Insurance (LMI): If your deposit is below 20%, LMI is likely required, increasing upfront costs.

- Loan Application and Establishment Fees: These vary across lenders but can be several hundred to a few thousand dollars.

- Legal and Conveyancing Fees: Essential for title transfer and ensuring compliance.

- Property Inspections and Valuations: Required by lenders to assess property value before approval.

A mortgage broker can provide a detailed cost breakdown and help you apply for pre-approval to clarify what you can afford before committing to a purchase. Source

Why You Should Consider Getting a Pre-Approval

Pre-approval is the process where a lender or broker assesses your financials and creditworthiness beforehand, providing you with a conditional borrowing limit. This can be a crucial advantage for investors in Perth because:

- It clarifies your budget: Knowing your borrowing capacity prevents overspending and narrows your property search.

- It strengthens your position: Sellers and agents take pre-approved buyers more seriously, speeding negotiation and securing deals.

- It streamlines the buying process: Less paperwork and quicker approval reduce the risk of missing out due to financing delays.

- It helps identify loan issues early: If documentation or credit issues exist, pre-approval reveals them early so you have time to resolve.

The pre-approval process usually lasts 90 days and involves submitting income evidence, assets, and liabilities. It’s advised to work with a knowledgeable Perth lending adviser who understands investment loans’ complexities. Source

Refinancing Investment Loans in Perth: Pros and Cons

Refinancing an investment home loan means replacing your existing mortgage with a new one, usually to improve terms or access equity. This option is popular among investors to optimise cash flow and investment potential.

Pros of Refinancing:

- Lower Interest Rates: Refinancing when market rates drop can save thousands over the loan term.

- Access Equity: Extract equity to fund additional investments or pay down higher-interest debts.

- Better Loan Features: Opportunity to switch to interest-only, split loans, or longer terms suited to your strategy.

- Consolidate Debt: Can merge other debts into your home loan for convenience and potentially lower rates.

Cons of Refinancing:

- Upfront Costs: Application fees, valuation fees, and legal costs can add up and may offset immediate savings.

- Higher Long-Term Costs: Rolling debts into a longer mortgage term may increase total interest paid.

- Qualification Requirements: Must meet lender criteria again, which might be tougher in changing markets.

- Break Fees: Some fixed loans charge penalties for exiting early.

Before refinancing, assess your timeline in the property; if you plan to hold short-term, the costs might outweigh savings. Consulting with a mortgage specialist helps run comprehensive cost-benefit analyses.

Have you considered whether refinancing your investment property loan might open better opportunities for you?

Investment Loan Structures & Strategies in Perth

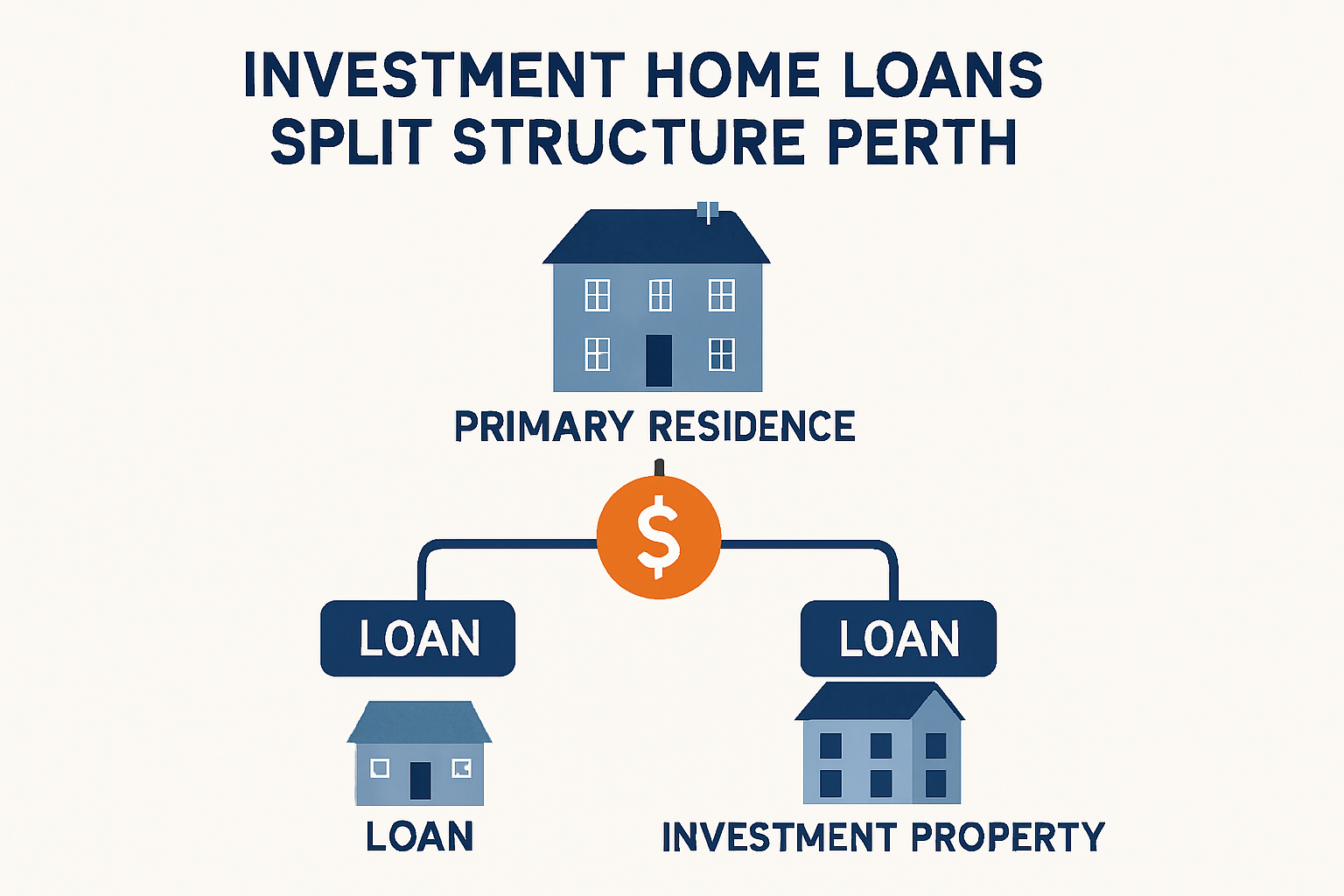

Structuring your investment loans strategically can enhance tax benefits, cash flow, and loan management. Many investors opt for split loans, separating owner-occupied loans from investment loans. Each loan portion has different tax treatment and lending conditions.

For instance, a common setup involves:

- One loan secured against your primary residence which is usually non-tax-deductible.

- A separate investment loan against the rental property, where interest and costs are tax-deductible.

This separation simplifies accounting and maximises legitimate deductions. Setting up offset accounts linked to each loan can reduce interest expenses and improve cash flow.

Experts recommend keeping dedicated bank accounts for investment property income and expenses, easing tax time reconciliations and audit readiness.

Local Expert Insights: Perth Investment Loans Landscape

Western Australia’s property market, including suburbs like Baldivis, Rockingham, Port Kennedy, and Wellard, has unique dynamics. Local lenders and brokers familiar with these areas provide tailored advice, considering regional property values, rental yields, and lender appetite.

Mortgage brokers in Perth are adept at navigating the complex loan products available, including options with flexible features and competitive rates. Using a broker can also provide access to lenders not available directly to consumers, broadening your borrowing options.

Given the variable property market and ongoing legislative changes, staying informed through trusted local sources and seeking personalised advice ensures you avoid common pitfalls and capitalise on market opportunities. Source

Common Mistakes to Avoid When Taking Investment Home Loans in Perth

- Underestimating Holding Costs: Many investors assume rental income will cover all expenses, but vacancies, repairs, insurance, and rates add up fast.

- Overextending Borrowing Capacity: Taking on loans beyond your financial comfort can lead to stress if market or income conditions change.

- Failing to Get Pre-Approval: Makes buying competitive properties harder and may delay the process.

- Ignoring Refinancing Opportunities: Not reviewing your loan structure periodically can mean missing out on better rates and terms.

- Not Consulting Professionals: Skipping mortgage brokers, accountants or property experts can leave money on the table or cause compliance issues.

Careful planning and ongoing review are key to managing investment home loans successfully.

FAQs About Investment Home Loans Perth

Can I get an investment home loan with a smaller deposit?

It’s uncommon, but some lenders may offer loans with less than 20% deposit with lenders mortgage insurance. However, most investment home loans in Perth require 20-25% deposit to avoid extra costs and complicated approval processes.

Are interest-only loans beneficial for investment properties?

Interest-only loans can improve cash flow short-term as you only pay interest (no principal). This may suit investors focused on capital growth or with fluctuating income. However, it means no equity build-up during the interest-only period and possibly higher costs long-term.

How important is credit score for investment loan approval?

A solid credit score, generally above 620, improves your chances to secure competitive rates and terms. A poor credit history can lead to loan denials or higher interest rates.

How often should I review or refinance my investment loan?

Review your loan terms annually or when market conditions shift notably. Refinancing may be beneficial if interest rates drop or your financial situation improves.

Should I use a mortgage broker or go directly to a bank?

Mortgage brokers have access to multiple lenders and can negotiate personalised loan structures. Engaging a Perth home loan broker is often a beneficial strategy.

Final Thoughts: Making the Most of Investment Home Loans in Perth

Investment home loans in Perth are powerful tools enabling property investors to grow their portfolios and generate income. With higher deposit requirements and stricter criteria, navigating this market needs expert advice and a clear strategy.

Start by assessing your financial position and goals in detail. Then work with a local mortgage broker to explore loan products tailored to your needs and suburb-specific opportunities in Perth and surrounding areas like Rockingham, Baldivis, and Port Kennedy.

Be proactive: obtain pre-approval, consider refinancing to optimise your loans, and maintain regular reviews to keep your investment loan working hard for you.

Property investment is an exciting journey that requires careful planning, but with the right knowledge and support, you can navigate investment home loans in Perth confidently and effectively.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your investment home loans Perth strategy? For personalised advice, contact us!