Construction loans are a popular choice for many homeowners and investors in Baldivis.

But what are construction loans baldivis exactly?

Here’s your complete cheatsheet for understanding construction loans tailored for Baldivis residents.

Some are designed to release funds in stages, matching your builder’s progress.

Some are interest-only during construction, saving you money early on.

Some come with flexible terms to manage your budget effectively.

Some provide peace of mind by linking valuations to ‘on-completion’ home value.

Let’s dive right in.

What Are Construction Loans and How Do They Work?

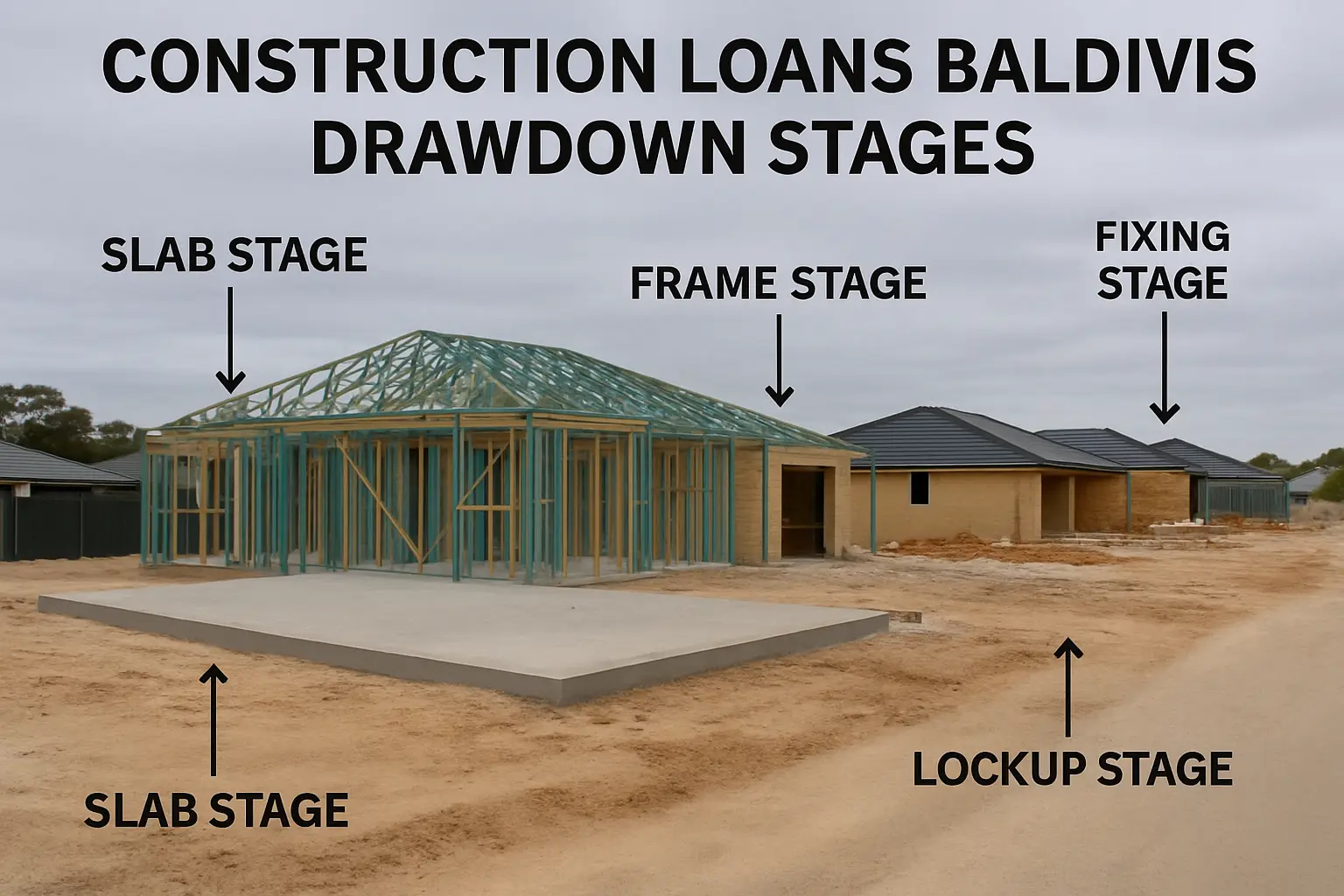

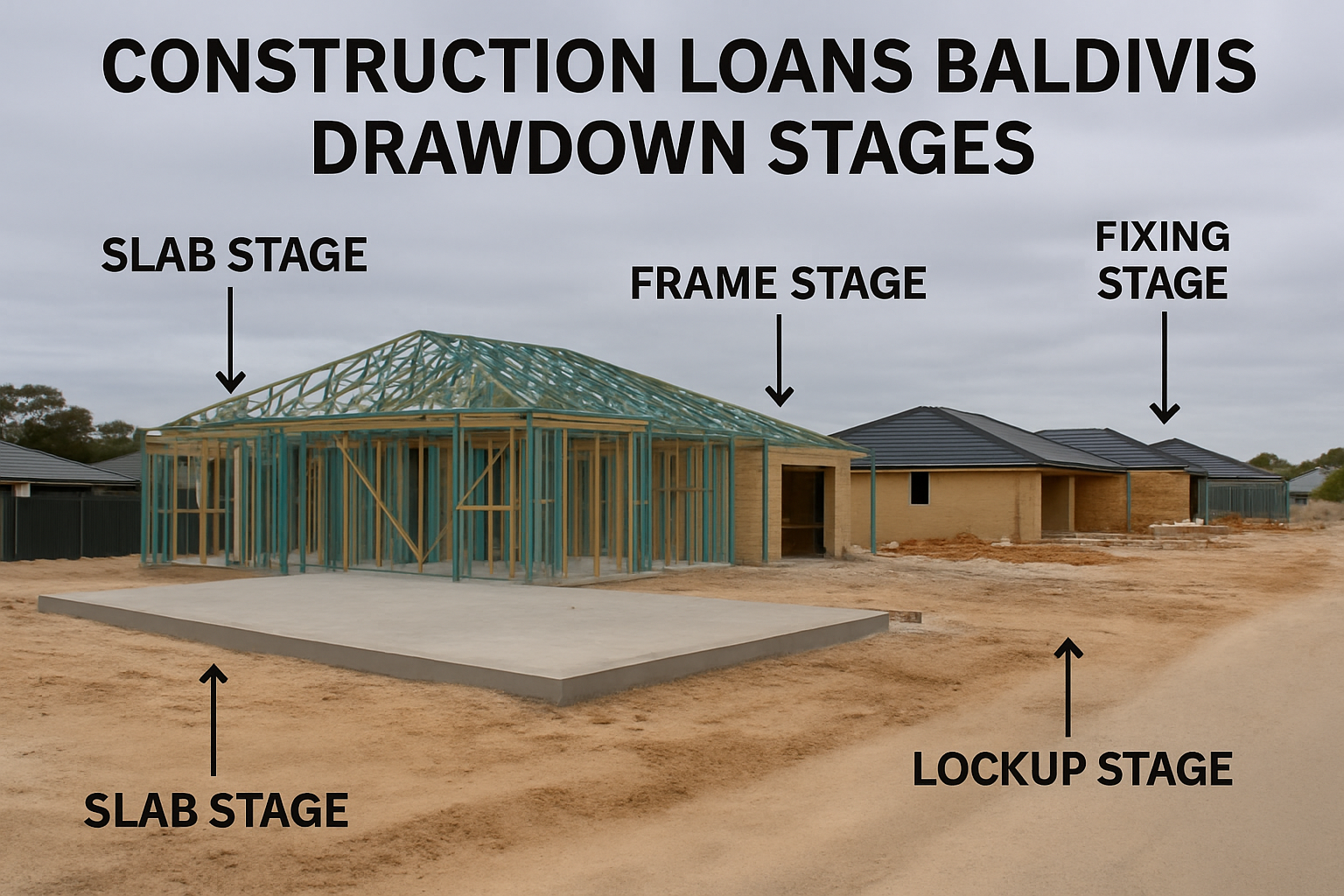

Construction loans are a specialised type of financing for building a new home or undertaking major renovations. Unlike traditional home loans that provide a lump sum upfront, construction loans distribute funds in stages, timed with construction milestones.

This staged drawdown means you only borrow what you need at each stage, helping manage cash flow. Typically, repayments during the build phase are interest-only on the drawn-down amount, reducing financial pressure until completion.

For example, your loan can cover initial land purchase, foundation laying, framing, lock-up, and finally practical completion. Each phase releases a drawdown amount to the builder after satisfactory progress claims.

This method benefits Baldivis home builders by aligning finance with real progress, avoiding paying interest on money you haven’t used yet.

Construction loans usually have variable interest rates reflecting the dynamic nature of building projects, so it’s vital to work with a knowledgeable lending adviser who understands local Baldivis market conditions.

Ready to see the full process? Here’s the typical flow you can expect in Baldivis:

- Land purchase: The initial stage covers buying your chosen Baldivis block.

- Foundation (Slab Down): Funds for site preparation and slab laying.

- Plate Height: Walls going up and your home starting to take shape.

- Frame/Roof: Constructing the structural frame and roof installation.

- Lock-up: Installing windows and doors to secure the building.

- Practical Completion: Final touches like interiors, painting, and landscaping.

Working through these stages with a construction loan ensures smooth financing tied directly to your builder’s progress.

Are you aware that managing construction funds carefully can be the key to avoiding costly overruns and delays? Strategic staging is essential to keep your dream home project on track.

Benefits of Construction Loans in Baldivis

Construction loans offer several unique advantages that traditional home loans do not accommodate, especially appealing for Baldivis property buyers.

- Tailored Financing: Loans fund each construction stage, aligning cash flow with actual work done, avoiding funding unnecessary delays.

- Interest Savings: Since interest is charged only on drawn amounts, not the total approved loan, you save money during construction.

- Flexibility: With interest-only repayments during construction, there’s less pressure on your monthly budget before your new home is live.

- Better Value Protection: Lenders base security on the land plus the projected value of the completed home, potentially requiring less upfront equity.

- Access to Grants: If you’re a first home buyer in Baldivis combining land and build loans, you might qualify for first home buyer grants and concessions at settlement.

Building in Baldivis with a construction loan allows you to tap into tailored loan features designed to suit the local market and build timelines.

But these loans are not without challenges. For instance, they require disciplined budgeting and a strong understanding of your builder’s schedule.

Here’s a bold tip for handling construction loans in Baldivis: Engage with a local home loan broker Baldivis who specialises in construction finance. Their expertise can be the difference between a hassle-free build and unexpected stress.

Curious about how you can leverage this tailored advice? Learn more about working with a mortgage broker Rockingham for expert, local guidance.

Considerations and Risks When Taking Construction Loans

While construction loans offer flexibility and benefits, they carry complexities that Baldivis home builders should know.

- Loan Complexity: Construction loans require constant coordination between the lender, borrower, and builder to approve drawdowns at each stage, with inspections and paperwork.

- Cost Overruns: Unexpected costs during building can impact budgets. Having contingency funds is critical to avoid project delays.

- Variable Interest Rates: These loans usually have variable rates, which can fluctuate and affect your repayments.

- Longer Approval Timelines: Compared to conventional loans, construction loans may take longer to get through due to more documentation and approval steps.

- Builder Approval: Some lenders require your builder to be approved or registered on their panel, which can limit your options.

Baldivis borrowers need to be proactive and maintain transparency with their loan provider. Regular communication with your lending adviser can help anticipate and manage these issues.

Wondering how you can prepare? Here’s an important question:

Have you calculated your borrowing capacity accurately to match both your land purchase and construction stages? Without this, you risk delays or surprises.

For guidance, check out our deep dive on managing low deposit home loans in the region via Low Deposit Home Loans Perth.

Expert advice can save you thousands — and keep your dream on track.

Step-by-Step Guide: Applying for a Construction Loan in Baldivis

Navigating construction loans can feel overwhelming, but breaking it down step-by-step makes it manageable.

1. Pre-Approval Before Signing Contracts

Obtain pre-approval from your chosen lender or through a construction loan focused home finance specialist. This defines your borrowing power and shows builders you are serious.

2. Choose Your Builder and Sign Contracts

Select a reputable builder in Baldivis with fixed-price contracts. Your loan specialist will often coordinate with your builder to ensure smooth progression.

3. Provide Detailed Documentation

You’ll need to submit your contract, property details, builder qualifications, and financial documents. Construction loans require more paperwork than standard loans.

4. Loan Approval and Drawdown Schedule Setup

Once approved, your lender will agree on a drawdown schedule matching your construction milestones. Funds release as each stage completes.

5. Managing Payments During Construction

Stay on top of your progress claims and communication with your builder. Interest-only repayments apply during this phase on drawn amounts.

6. Final Loan Conversion at Completion

After practical completion and inspection, the loan converts to a standard principal and interest repayment schedule.

Each of these steps benefits from expert support. Working alongside your home loan broker Baldivis can streamline the complexity.

Have you prepared your financial documents or builder quotes yet? That’s a great first step.

To get personalised loan options suited to your Baldivis project, consider contacting a mortgage specialist who understands this niche.

Baldivis Property Market Trends and Construction Loan Insights

Baldivis is an ever-growing suburb with rising demand for new homes and land packages. This demand influences construction loan dynamics directly.

Recently, house and land packages in Baldivis have gained attention for affordable pricing combined with excellent access to amenities and transport links.

The strategic location close to Perth CBD and major highways makes Baldivis attractive for first home buyers and property investors alike.

With land becoming scarcer, securing finance with well-planned construction loans boosts your ability to act fast on available blocks.

Construction loan experts report that lenders are increasingly tailoring loan products specific to regions like Baldivis, reflecting local conditions and costs.

For more detailed local market updates and loan advice, visit our comprehensive home loan broker Perth guide that complements this regional perspective.

Remember: Construction loans are not one-size-fits-all. Your financial adviser can factor in Baldivis-specific data like rising material costs, land availability, and local government approvals.

Frequently Asked Questions About Construction Loans Baldivis

Are construction loans suitable for first home buyers in Baldivis?

Absolutely. Combining your land and construction loan can simplify finance, and you may qualify for government grants and stamp duty concessions at the land settlement stage, excellent for first home buyers.

Can I switch lenders after construction is complete?

Yes. Many borrowers refinance their construction loan into a traditional home loan after completion to access better rates or features.

What if my build goes over budget?

It’s crucial to have contingency funds. Your broker and builder should help estimate realistic costs, but unexpected expenses can arise. Good communication and planning help manage this risk.

How do interest rates on construction loans compare to traditional home loans?

Construction loans typically have slightly higher variable rates during construction to offset risk, but interest-only repayments during this phase can ease cash flow.

Can I use a construction loan for major renovations?

Yes. Construction loans can fund extensive renovations or additions, not just new builds, as long as the project fits lender guidelines.

Where can I find expert advice for construction loans in Baldivis?

Connecting with local mortgage specialists who understand the Baldivis market is essential. They guide you through loan options, eligibility, and the application process, ensuring you get the best fit for your situation.

Video Insight: Financing a House and Land Package

We recommend watching this insightful video that discusses top tips for securing finance when buying a house and land package. It highlights key financial preparation steps and lender expectations, perfect for Baldivis buyers:

This video underscores the importance of understanding your budget, managing debt, and selecting the right financial adviser when pursuing construction loans.

Applying this knowledge can make your Baldivis build journey more confident and successful.

How a Mortgage Broker Can Simplify Your Construction Loan Journey in Baldivis

Working with a mortgage broker or lending adviser who is versed in construction loans can be a game-changer. They act as your advocate, comparing hundreds of products from multiple lenders including specialists in the Baldivis area.

Here’s what partnering with a local broker gives you:

- Access to tailored construction loan products: Not all loans are created equal. Brokers uncover options aligned with your build and financial goals.

- Expert guidance through complex stages: From pre-approval to final drawdown, they keep track of paperwork and deadlines.

- Improved borrowing power: Brokers optimise your application with refined income and expense analysis, increasing your chance of approval.

- Connection to government schemes and grants: Australian programs supporting first home buyers and construction financing can be complex; brokers simplify eligibility and application.

- Ongoing support: Your financial needs may change during construction; a good mortgage specialist adjusts your loan accordingly.

For trusted local advice, check out our guide to home loan brokers in Perth, packed with actionable advice and WA-specific policies. This can help you make an informed choice and secure a construction loan that suits your Baldivis project perfectly.

If you’re interested, Elend Finance is one of several reputable sources that highlight the importance of choosing an adviser familiar with construction finance complexities in WA.

Now, a question for reflection: Have you considered talking to a broker who specialises in your local area to get personalised loan options for your build?

Insider Tips for Baldivis Home Builders Considering Construction Loans

Drawing from conversations with local experts and lenders, here are some practical tips to help Baldivis builders secure and manage construction loans effectively:

- Stay employed and stable: Lenders prefer applicants with steady jobs for at least 3-6 months to avoid delays.

- Be transparent with your finances: Disclose all debts and expenses. Hidden obligations can’t be ignored and may derail approvals.

- Work with builders who understand financing: Builders used to dealing with staged drawdowns smooth the process considerably.

- Keep communication open: Regularly update your lending adviser on progress and any issues that arise during construction.

- Plan your borrowing capacity carefully: Use tools and expert advice to realistically assess what you can afford, including contingencies.

- Understand government grants and concessions: WA offers programs like the First Home Owner Grant and Keystart loans beneficial for eligible buyers.

These tips align with guidance shared by the Loan Market brokers who specialise in making home buying clear and straightforward.

Many first home buyers in Baldivis find this knowledge invaluable as they embark on their building journey.

By carefully applying these insights, you reduce stress and increase your chances of financing success.

Summary and What to Do Next

Construction loans in Baldivis offer a flexible, tailored way to finance your dream home carefully aligned to building stages. The benefits include interest savings, aligned drawdowns, and access to tailored products suitable for first home buyers and investors alike.

But navigating construction loans requires expert guidance, thorough planning, and clear communication. Understanding the staged loan process, risks of cost overruns, and managing repayments during construction helps protect your investment.

Utilise the expertise of a local home loan broker Baldivis focussed on construction loans. Their knowledge translates into smoother approvals and personalised loan structures.

For more expert insights, explore our Ultimate Guide to Choosing a Mortgage Broker Rockingham, which shares valuable tips applicable to Baldivis and nearby suburbs.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your construction loans Baldivis journey? For personalized advice, contact us!

Remember, your dream home starts with smart finance—let’s get building!